On Tuesday, digital radio programmer Sirius Satellite (SIRI-$3.71) said it had paid its on-air personality Howard Stern an $83 million stock-based performance bonus, which was tied to subscriber targets set when Stern signed a $500 million contract with the Company in October 2004.

Commenting on the shock jock’s earn-out, management said the bonus to Stern would not increase its diluted share count and that expenses related to the payment have been reflected in operating results throughout 2006. [Ed. note. SIRIUS recognized a non-cash expense associated with these shares of $224.8 million during the nine months ended September 30, 2006.]

For the nine-months ended September 30, 2006, Sirius recorded a net loss of $(859.3) million, or a share-net loss of 61 cents, on $443.8 million in revenue.

The Company’s remarks, however, betray the truth.

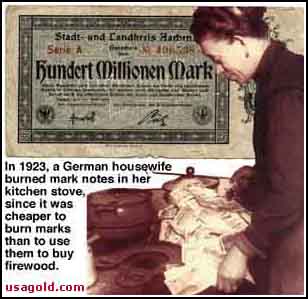

The similarity between 1924 Germany and present-day SIRIUS should be cause for concern to SIRIUS stockholders.

In 1922, the highest denomination in post-war Germany was 50,000 mark. By 1924 the denomination had increased more than 20,000-fold. [Forgive us for hyperbole] From 2000 to 2006, the number of shares of common stock outstanding of SIRIUS has increased 50-fold [balance on January 1, 2000, was 28.7 million shares].

Like the the Weimar Republic of Germany issuing fifty-million-mark banknotes and postage stamps with a face value of fifty billion mark, Sirius’ growth model is predicated on the calculus that to fund its OEM distribution channel and content library—to attract new subscribers—all the Company need do is issue more-and-more—in their case, the currency of choice is common stock and/or warrants.

Changing the way people listen to music, sports, news, and entertainment does not come cheap. SIRIUS is authorized to issue 2.5 BILLION shares of its common stock. As of September 30, 2006, the Company had about 1.4 billion shares outstanding (with total stockholder deficit of $200.3 million).

In addition, as of Dec 31, 2006, the Board is currently authorized to issue, without stockholder approval, up to approximately 620 million additional shares of common stock, reserved for issuance in connection with outstanding convertible debt, warrants, incentive stock plans and common stock (to be granted to third parties upon satisfaction of performance targets).

Editor David J Phillips is now posting one day a week at Investor-Advantage. Please stop by for a visit to read this article in its entirety.

3 comments:

other than SIRI=cash burning machine...what are you trying to say here. As to say the informed have known about the SIRI machine for some time now....what has changed.

M

SIRI management is using their stock like mark-denominated currency in 1924 Germany. They're cheapening the value--thru dilution-- for shareholders by hyper-issuing shares to procure distribution and content deals. Does this business model not concern you?

Reverse splits are stupid, Rick

I hear you. Reverse splits are the handiwork of the desperate, typically enacted by companies that are trying to break their fall on their way down to zero. Issuing a split is also a zero-sum game. If Sirius declares a 1-for-20 reverse stock split, where every 20 shares would be replaced with a single new share, it wouldn't change much.

Post a Comment