MSU = Russell 2000 // IXIC = Nasdaq Stock Market

---------------------------------------------------------

On September 8, SmartVideo Technologies, Inc. (SMVD.OB-$1.28), a provider of video content distribution services, filed its Annual Proxy Statement with the SEC. After a read though, we agree with Yogi Berra, when he said: “ nickel ain't worth a dime anymore.”

In its press releases, corporate says that its core competence centers around a proprietary technology platform that is optimal “for the efficient utilization of Internet bandwidth in conjunction with—high quality picture and sound—streaming video. Management believes that the Company is able to deliver to its customers one of the widest selections of programming available today.”

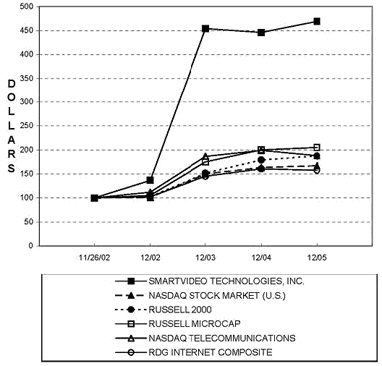

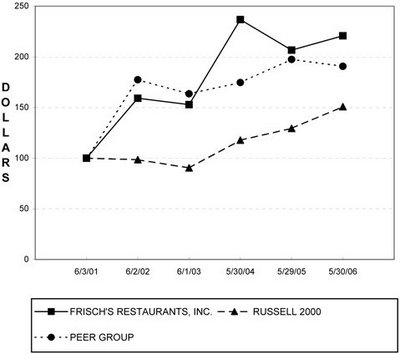

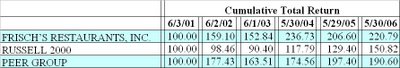

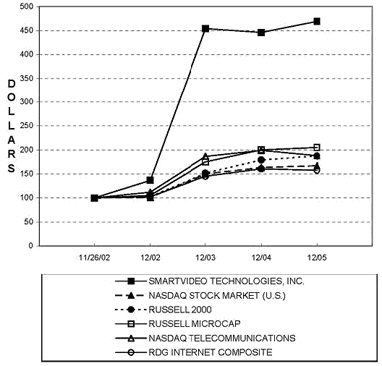

If one were to just look at the 37-month (cumulative) Total Return chart [provided by management] that compares the Common Stock performance to small-cap indexes one would see that $100 invested on November 26, 2002 in Smart Video stock would have grown to $469.14 on December 31, 2005, compared to $166.96 and $187.39 (including reinvestment of dividends) for a $100 investment in the Nasdaq Stock Market and the Russell 2000, respectively.

Stock Performance Graph The following graph compares the changes over the last five years in the value of $100 invested in (i) the Common Stock, (ii) the Nasdaq Stock Market, (iii) the Russell 2000, (iv) the Russell Microcap, (v) the Nasdaq Telecommunications, and (vi) the RDG Internet Composite indicies. The year-end values of each investment are based on share price appreciation and the reinvestment of all dividends.

Historical stock price performance shown on the performance graph is not necessarily indicative of future stock price performance.

COMPARISON OF 37 MONTH CUMULATIVE TOTAL RETURN*

AMONG SMARTVIDEO™ TECHNOLOGIES, INC. . .

* $100 invested on 11/26/02 in stock or on 10/31/02 in index-including reinvestment of dividends.

* $100 invested on 11/26/02 in stock or on 10/31/02 in index-including reinvestment of dividends.

| Fiscal year ending December 31 |

| | November 26 | | December 31 | | December 31 | | December 31 | | December 31 |

| | 2002 | | 2002 | | 2003 | | 2004 | | 2005 |

| | | | | | | | | | |

| Smart Video | $ | 100 | $ | 136.46 | $ | 453.97 | $ | 445.95 | $ | 469.14 |

| Nasdaq Stock Market | | 100 | | 100.73 | | 150.07 | | 163.19 | | 166.96 |

| Russell 2000 | | 100 | | 102.86 | | 151.46 | | 179.23 | | 187.39 |

| Russell Microcap | | 100 | | 105.28 | | 175.15 | | 199.92 | | 205.05 |

| Nasdaq Telecommunications | | 100 | | 112.13 | | 186.54 | | 199.07 | | 187.88 |

| RDG Internet Composite | | 100 | | 102.41 | | 145.19 | | 160.51 | | 157.64 |

| Date | Open | High | Low | Close | Volume | Adj. Close |

| 30-Dec-05 | 5.50 | 5.52 | 5.18 | 5.26 | 136,900 | 5.29 |

| 31-Dec-04 | 4.60 | 5.02 | 4.55 | 5.00 | 68,700 | 5.00 |

| 31-Dec-03 | 5.00 | 5.25 | 4.95 | 5.09 | 32,600 | 5.09 |

| 31-Dec-02 | 0.49 | 0.52 | 0.48 | 0.51 | 58,000 | 1.53 |

| 26-Nov-02 | 0.38 | 0.38 | 0.35 | 0.37 | 150,400 | 1.11 |

|

| Smart Video Technologies 6-Jan-03 | 1:3 Stock Split |

| 01-Sep-06 | 1.07 | 1.13 | 0.96 | 1.05 | 30,900 | 1.05 |

To remind our readers—the Proxy was filed on September 8, 2006. The Common Stock traded at 52-week intra-day high on December 5, 2005, when it hit $7.60 per share. Since peaking on December 5, the stock has lost more than 86.2% of its market value (as of August 31, 2006).

In fact, as August 31, 2006, contrary to management’s ‘cut & paste’ job, adjusted for the reverse 1:3 stock split, an investor who put $100 in the Common Stock of SmartVideo on November 26,2002, would have witnessed his (approximate) 270 shares reduced to 90 shares; and, as of September 1, 2006, the investor’s holdings would be worth $94.50—quite a difference than the $469.14 value that management bragged about on December 31, 2005!

Ivana Trump, on finishing her first novel, remarked, “Fiction writing is great, you can make up almost anything."

A review of the Company’s quarterly filings with the SEC paints a different picture than the company shown in the aforementioned graph. SmartVideo is a company in distress. As of June 30, 2006, SmartVideo had an accumulated deficit of approximately $49.6 million.

SmartVideo is also a company with a less-than-certain future. As of June 30, 2006, the Company reported a working capital deficiency of approximately $2.6 million.

Mmanagement anticipates, “based on its proposed plans and assumptions relating to operations that the net proceeds from the closing of its most recent financing in July 2006, together with revenues generated from operations, will not be sufficient to meet the cash requirements for working capital and capital expenditures beyond June 2007…. if adequate funds are not available or not available on acceptable terms, SmartVideo will be unable to continue as a going concern.”

For the year ended December 31, 2005, SmartVideo lost $19.7 million on revenue of $197,257.

The income statement shows that SG&A contributed close to 48% of this net loss. As we could not find a comprehensive listing of Key Executives and their total compensation packages for FY 2005, this only leaves us more curious—on whom—or how—is management spending their limited capital resources?

According to management, SG&A increased approximately $1,449,000 year-over-year when compared to 2004. In their 10-K filing, the jump in expenses was associated with the executives’ “participation in numerous trade shows and the extra costs attributable to the decision to develop a prominent presence in each of these events. The Company also incurred additional travel related and marketing costs associated with specialized consultants hired to assist management in this process.”

As if the aforementioned was not troubling enough, the 10Q Detective takes issue with corporate governance at the Company. In particular, we differ with management on the ‘independence’ of certain directors who sit on the audit and compensation committees.

The Compensation Committee is responsible for reviewing and approving the executive compensation program for the Company, assessing executive performance, making grants of salary and annual incentive compensation and approving certain employment agreements. According to the Company, each member of the Compensation Committee is an “independent” director; as such term is defined by the applicable listing standards of the Nasdaq Stock Market.

The Compensation Committee is comprised of Glenn Singer, Justin Stanley and Michael Criden, who beneficially own 8.6%, 1.4%, and 6.4% of the Common Stock outstanding, respectively. Nasdaq has stated that ownership of company stock by itself does not preclude the Board from concluding that such shareholder(s)/director(s) is grounds for compromised independent judgment.

The primary duties of the Audit Committee are to are to serve as an independent and objective party to monitor the Company’s financial process and the internal control system, to review and appraise the audit effort of the Company’s independent accountants and to provide an open avenue of communication among the independent accountants, financial and senior management of the Company and the Board of Directors. The Audit Committee is comprised of Michael Criden, Glenn Singer, and Justin Stanley.

The Board of Directors determined that each of the Audit Committee members is an “independent” director within the meaning of such listing standards of the Nasdaq Stock market.

Among other definitions, Nasdaq consider persons who are not independent to be “a director who is a partner in, or controlling shareholder or executive officer of, any organization to which…the company received payments that exceed the greater of 5% of the company’s consolidated gross revenues for that full year, or $200,000, whichever is greater, in the current fiscal year, or any of the past three years.”

On July 18, 2005, Justin A. Stanley was appointed a member of the Board of Directors of the Company. On August 12, 2005, the Company borrowed $225,000 from Mr. Stanley. [Full Disclosure: The principal amount of this note was repaid to Mr. Stanley on November 22, 2005.]

On November 21, 2005, Michael Criden and Glenn Singer were appointed as member of the Board of Directors of the Company. On September 26 and October 19, 2005, Michael E. Criden and Glenn H. Singer and GHS Holdings Limited Partnership, a company controlled by both men, loaned the Company a total of $600,000. In exchange for the loans, the Company issued convertible promissory notes and warrants to each of Messrs. Criden and Singer and GHS Holdings Limited Partnership.

"I get to go to lots of overseas places, like Canada." - Britney Spears, Pop Singer.

No interference with independent judgment? A rising stock price (with an outdated stock chart)—to signal all is well at the Company? Foxes watching the hen-house? And who is watching the foxes? SmartVideo must think it has dumb shareholders.

Editor David J Phillips does not own any of the stocks mentioned in this article. You can see his portfolio holdings in the sidebar. The 10Q Detective has a full disclosure policy.