Frisch’s Restaurants, Inc. (FRS-$24.70), is a regional company that operates 90 full service family-style restaurants under the name “Frisch’s Big Boy,” located primarily in various regions of Ohio, Kentucky and Indiana. Menus are generally standardized with a wide variety of items at moderate prices, featuring well-known signature items such as the original “Big Boy” double-deck hamburger sandwich, freshly made onion rings and hot fudge cake for dessert.

Frisch’s Restaurants, Inc. (FRS-$24.70), is a regional company that operates 90 full service family-style restaurants under the name “Frisch’s Big Boy,” located primarily in various regions of Ohio, Kentucky and Indiana. Menus are generally standardized with a wide variety of items at moderate prices, featuring well-known signature items such as the original “Big Boy” double-deck hamburger sandwich, freshly made onion rings and hot fudge cake for dessert.The Big Boy marketing strategy - “What’s Your Favorite Thing?” – has been in place for almost nine years. Results from ongoing market research lead the Company to believe its effectiveness has not diminished. Television commercials are broadcast on local network affiliates and local cable programming emphasizing Big Boy’s distinct and signature menu items.

The Company also operates 34 grill-buffet style family restaurants offering a wide variety of buffet items under the name “Golden Corral.” All of these eateries are fitted with charbroil grills placed directly on the buffet line. This format has allowed customers to be served grilled-to-order steaks directly from the buffet line as part of the regular buffet price. This “Great Steaks Buffet” strategy also features many other varieties of meat including fried and rotisserie chicken, meat loaf, pot roast, fish and a carving station that rotates hot roast beef, ham and turkey. The buffet also includes fresh fruits and vegetables, other hot and cold buffet foods, a salad bar, desserts, an in-store display bakery that offers made-from-scratch bakery goods every fifteen minutes, and many beverage items (none of which contain alcohol). Most of the food is prepared in full view of customers in order to emphasize its freshness and quality.

The Company’s vision is to be the “best large owner/operator of franchised, multi-location restaurant concepts within 500 miles of Cincinnati.”

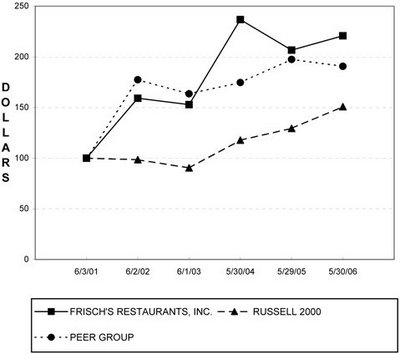

If our readers were to only look at the Common Stock Price Comparative Performance Graph supplied by Frisch’s management in their recently filed Proxy Statement, the observable conclusion reached would be that the Company was well on its way to being ‘the best.’

-------------------------------------------------------------------------------------

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG FRISCH’S RESTAURANTS, INC., THE RUSSELL 2000 INDEX

AND A PEER GROUP

AMONG FRISCH’S RESTAURANTS, INC., THE RUSSELL 2000 INDEX

AND A PEER GROUP

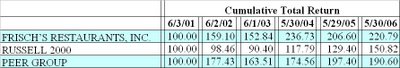

The graph compares the yearly percentage change in the Company’s cumulative total stockholder return on its Common Stock over the five year period ending May 30, 2006 with the Russell 2000 Index and a group of the Company’s peer issuers, selected by the Company in good faith. The graph assumes an investment of $100 in the Company’s Common Stock, in the Index and in the common stock of the peer group on June 3, 2001 and reinvestment of all dividends.

The Peer Group selected by the Company “in good faith” consisted of the following issuers: Bob Evans Farms, Inc. (BOBE), Steak n Shake Co. (SNS), CBRL Group, Inc. (CBRL), IHOP Corp. (IHP), Ryan’s Restaurant Group Inc. (RYAN), and Friendly Ice Cream Corp. (FRN).

-------------------------------------------------------------------------------------

Friendly Ice Cream Corp., the restaurant chain famous for its "Fribble" ice cream-based drink, and IHOP Corp, the franchise better known for its pancakes than its steaks, both have histories of erratic financial performance and troubled credit and debt ratings.

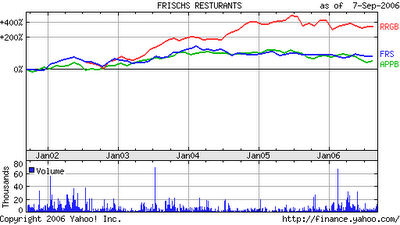

If the Company were to have included Applebee's International Inc. (APPB) and Red Robin Gourmet Burger (RRGB) in their Peer Group analysis, the five-year cumulative total return of Frisch’s Common Stock would not have looked as robust.

Of interest, a peer analysis of key financial metrics leads the 10Q Detective to conclude that Frisch’s “Big Boy” double-deck hamburger smells more like a turkey-burger!

Profitability Ratios:

1. Operating Margin for Past 5-Years. FRS-6.0% Industry-12.0%

2. Net Margin for Past 5-Years. FRS-4.1% Industry-7.3%

Management Effectiveness Ratios:

1. ROA for Past 5-Years. FRS-7.1% Industry-8.7%

2. ROE for Past 5-Years. FRS-13.7% Industry-14.9%

Growth Rates:

1. Sales Growth for Past 5-Years. FRS-8.9% Industry-12.9%

2. EPS Growth for Past 5-Years. FRS-6.8% Industry-15.8%

Corporate Governance

Frisch’s—as described—is a family-style restaurant chain. Management’s ignis fatuus cannot hide the fact that this is a Maier family restaurant—and the relatives are overindulging at the buffet.

Until his death on February 2, 2005, Jack C. Maier served as Chairman of the Board. Jack C. Maier was the husband of Blanche F. Maier, and upon his death, the Company began paying to his widow, Blanche F. Maier (for each of the next ten years) the amount of $214,050, adjusted annually to reflect annual percentage changes in the Consumer Price Index.

Craig F. Maier (President and Chief Executive Officer) and Karen F. Maier (Vice President – Marketing) are siblings and are the children of Blanche F. Maier.

Blanche, Craig, and Karen (combined) beneficially own 75.1% of the outstanding Common Stock of the Company.

Despite dismal financial performance (as measured by operating margin) in the FY ending May 30, 2006, the Board granted to Craig Maier 20,000 options—which represented 28% of the total options granted to ALL employees in FY 2006.

Craig Maier’s annual bonus is indexed to pre-tax earnings: total sales formula. He earned approximately $1.08 million in incentive dollars (for lackluster and erratic operational performance) in the last three fiscal years. He is also sitting on $1.9 million of unexercised (and in the money) stock options.

Members of Blanche F. Maier’s family—including Craig—are financially invested in three Big Boy franchises, too.

Scott Maier, a Construction Manager at the Company, is the son of Blanche F. Maier and the brother of Craig F. Maier and Karen F. Maier. During the fiscal year ended May 30, 2006, Scott Maier received a salary of $64,891 and an auto allowance of $5,256.

After reading Frisch’s Restaurants’ Proxy Statement in its entirety—we lost our appetite.

If the Company were to have included Applebee's International Inc. (APPB) and Red Robin Gourmet Burger (RRGB) in their Peer Group analysis, the five-year cumulative total return of Frisch’s Common Stock would not have looked as robust.

Of interest, a peer analysis of key financial metrics leads the 10Q Detective to conclude that Frisch’s “Big Boy” double-deck hamburger smells more like a turkey-burger!

Profitability Ratios:

1. Operating Margin for Past 5-Years. FRS-6.0% Industry-12.0%

2. Net Margin for Past 5-Years. FRS-4.1% Industry-7.3%

Management Effectiveness Ratios:

1. ROA for Past 5-Years. FRS-7.1% Industry-8.7%

2. ROE for Past 5-Years. FRS-13.7% Industry-14.9%

Growth Rates:

1. Sales Growth for Past 5-Years. FRS-8.9% Industry-12.9%

2. EPS Growth for Past 5-Years. FRS-6.8% Industry-15.8%

Corporate Governance

Frisch’s—as described—is a family-style restaurant chain. Management’s ignis fatuus cannot hide the fact that this is a Maier family restaurant—and the relatives are overindulging at the buffet.

Until his death on February 2, 2005, Jack C. Maier served as Chairman of the Board. Jack C. Maier was the husband of Blanche F. Maier, and upon his death, the Company began paying to his widow, Blanche F. Maier (for each of the next ten years) the amount of $214,050, adjusted annually to reflect annual percentage changes in the Consumer Price Index.

Craig F. Maier (President and Chief Executive Officer) and Karen F. Maier (Vice President – Marketing) are siblings and are the children of Blanche F. Maier.

Blanche, Craig, and Karen (combined) beneficially own 75.1% of the outstanding Common Stock of the Company.

Despite dismal financial performance (as measured by operating margin) in the FY ending May 30, 2006, the Board granted to Craig Maier 20,000 options—which represented 28% of the total options granted to ALL employees in FY 2006.

Craig Maier’s annual bonus is indexed to pre-tax earnings: total sales formula. He earned approximately $1.08 million in incentive dollars (for lackluster and erratic operational performance) in the last three fiscal years. He is also sitting on $1.9 million of unexercised (and in the money) stock options.

Members of Blanche F. Maier’s family—including Craig—are financially invested in three Big Boy franchises, too.

Scott Maier, a Construction Manager at the Company, is the son of Blanche F. Maier and the brother of Craig F. Maier and Karen F. Maier. During the fiscal year ended May 30, 2006, Scott Maier received a salary of $64,891 and an auto allowance of $5,256.

After reading Frisch’s Restaurants’ Proxy Statement in its entirety—we lost our appetite.

No comments:

Post a Comment