Matrix Asset Advisors Inc., in a letter dated September 11, urged the Board of electrical systems maker American Power Conversion Corp. (APCC-$20.73) to sell the Company, on the grounds that its stock price did not reflect the company's "intrinsic value."

According to regulatory filings, Matrix, a $1.6 billion large-cap value fund, beneficially owns 2.38 million American Power shares, or about 1.25 percent of the outstanding stock.

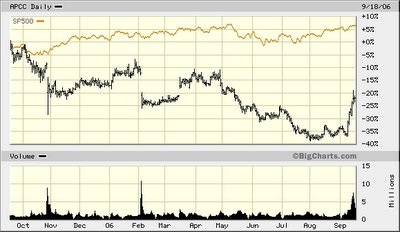

The Common Stock of American Power has lost 20.7% in market value in the last year, as compared to a 7.3% gain in the S&P 500 in the same period.

American Power markets power protection equipment and related software and accessories for computer, communications, and related equipment. The Company has three operating segments:

*The Small Systems segment provides both surge and back-up power protection for PC and home electronics, UPS (uninterruptible power supply) and management products for the PC, server and networking markets (both local area and wide area).

American Power is benefiting from the increasing digitalization of the economy and the subsequent need for uninterruptible power supplies. The Small Systems segment posted healthy results for the second quarter ending June 30, 2006, increasing 12 percent year-over-year to $399.6 million. Demand for American Powers’ online single-phase Smart-UPS solution, the Smart-UPS RT, and summer demand for Back-UPS desktop UPSs were top drivers of growth in the segment during the quarter.

Second quarter 2006 gross margins, however, for the Small Systems segment of 41.5% declined 370 basis points from the comparable period in 2005. The Company attributes the year-over-year margin decline to higher freight and logistics costs, and pricing and mix shifts.

*The Large Systems segment provides systems, products and services that primarily provide back-up power, power distribution and precision cooling equipment for data centers, facilities, and communications equipment for both commercial and industrial applications. This on-demand architecture for network-critical physical infrastructure (NCPI) is dubbed InfraStruXure.

American Power is looking to capitalize on its brand image and dominance in the small systems market to drive commercial awareness and subsequent adoption of its Large Systems product offerings by data centers. For the second quarter 2006, revenue in American Power’s Large Systems segment, consisting primarily of 3-phase uninterruptible power supplies (UPSs), APC Global Services, precision cooling and ancillary products for data centers, facilities and communication applications, increased 33 percent year-over-year to $139.5 million.

The problem—as articulated in Matrix Asset Advisor’s letter to management--is reflected in the Common Stock share price. Investors are wondering how management is expecting to jumpstart growth on lower margin offerings? Second quarter 2006 gross margin for the Large Systems segment was 18.5%, an increase of 20 basis points from the comparable period in 2005.

Irritating investors, too, was that on the Company’s 2Q:06 conference call, management refused to give a timeline when it expected a return to renewed profit growth. Instead, American Power steered shareholders to its continued need to spend dollars on sales & marketing initiatives, both “essential to branding the data center and establishing American Power as a leader in the NCPI market.”

The Company said, too, that margins will continue to be pressured in coming quarters because of capital spending needs dedicated to expanding future capacity (to meet expected future demand for Large Segment offerings) and lowering overhead in existing production facilities.

Net sales for products in the Other segment, consisting principally of mobile accessories and replacement batteries, decreased in the second quarter of 2006 by 4.7% (over the 2Q:05) to $15.6 million, due to a decrease in demand.

Second quarter 2006 gross margins for the Other segment of 55.2% decreased 130 basis points from the comparable period in 2005. Pricing and material costs negatively impacted this segment’s gross margins.

Net revenue for the second quarter 2006 was $560.0 million, up 17 percent from $480.6 million in the second quarter 2005. Net income for the second quarter 2006 was $24.7 million or $0.13 per share, down 41 percent from $41.9 million or $0.21 per diluted share in the second quarter 2005.

Corporate Governance Issues

On August 15, 2006, American Power said Rodger Dowdell, Jr. was retiring as President and Chief Executive Officer, effective immediately (collecting $2.0 million in severance). Although Dowdell will continue to serve on the board as non-executive Chairman, the board named Rob Johnson as President and CEO on an interim basis.

Johnson’s promotion serves his family well—unlike a sale of the Company.

Dug out from an 8K-A (filed on August 22, 2006):

“Mr. Johnson joined the Company in 1997 when it acquired Systems Enhancement Corporation, a family-owned and operated power management software firm, where he held the position of President. When Systems Enhancement Corporation was acquired by the Company, other members of Mr. Johnson’s immediate family were, and continue to be, employees of System Enhancement Corporation, which is currently a wholly owned subsidiary of the Company. These members of Mr. Johnson’s immediate family are: Richard Johnson, a brother; Patrick Johnson, a brother; James Johnson, a brother; and James Rigman, a brother-in-law. As employees of Systems Enhancement Corporation, these members of Mr. Johnson’s immediate family are paid an annual salary (which salaries range from $108,000 to $165,000) and are eligible for annual cash bonuses.

In addition, the father of Mr. Johnson, Rollie Johnson, provides consulting services to Systems Enhancement Corporation on an hourly basis. Systems Enhancement Corporation paid Rollie Johnson $139,400 for consulting services provided in 2005 and he has been paid $112,500 for consulting services provided in 2006 through the date of this report.”

Valuation Analysis

American Power is selling for 23.8 times forward December 2007 consensus estimates of $0.87 per share (slightly lower than its trailing five-year median of 24.9 times earnings). The Company’s trailing twelve-month operating margin and ROE were 6.3% and 6.8%, respectively.

Industrial equipment maker and competitor Emerson Electric (EMR-$82.65) sells for 16.5 times December 2007 consensus estimates of $5.02 per share. On a trailing-twelve-month basis, EMR sports an operating margin and ROE of 15.3% and 22.6%, respectively.

In our view, we cannot see any visible catalysts to drive American Power’s stock price significantly higher (save for buyout speculation).

Investment Risks & Considerations

On a trailing twelve-month basis, the Company’s free cash flow was $(59.1) million. Nevertheless, the Company carries no long-term debt and has almost $3.00 per share in cash.

Efficiency ratios. In the last two years: Days-of sales outstanding have held steady at about 64 days; Days inventory dropped (trailing twelve-months) to 140 days compared to 146 and 156 in 2005 and 2004, respectively; Cash conversion cycle has improved 11 days to 166 days (2004 to TTM).

Gross margin variability could continue to adversely affect financial performance. Overall gross margins may be negatively impacted by increased operational costs, price reductions, and a continued shift in product mix toward the faster-growing, but lower-margin, Large Systems products (increased operational costs, including freight and warehousing, associated with the re-architecture of our supply chain). Additionally, the Company’s move into the Larger Systems market could cause competitors like EMR to respond with aggressive price-cutting to retain market share.

In our view, as the Company becomes more dependent on the Larger System segment for top-line growth, its business will become more cyclical in nature, too, due to a growing dependence on corporate IT spending needs.

1 comment:

Post a Comment