In a memo to Dell Inc. (DELL-$23.80) employees, days after returning as chief executive officer, Michael Dell wrote,” We had great efforts, but not great results. This is disappointing and unacceptable."

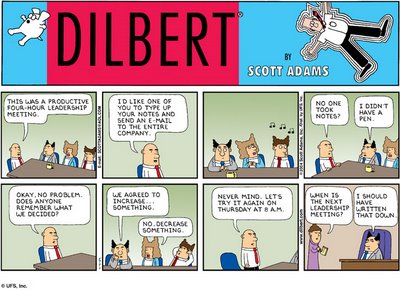

In a memo to Dell Inc. (DELL-$23.80) employees, days after returning as chief executive officer, Michael Dell wrote,” We had great efforts, but not great results. This is disappointing and unacceptable."Consequently, Dell said the struggling computer maker is halting staff bonuses for 2006 and reducing — to 12 from more than 20 — the number of people reporting directly to the CEO (to help cut costs).

Details of the shake-up came after Michael Dell replaced Kevin Rollins as CEO on Wednesday, returning to the helm of one of the world's largest PC manufacturers, founded by Dell in 1984. The change came as Dell tries to fix mounting problems that include disappointing earnings reports, eroding market share and an ongoing federal accounting probe.

Speaking of cost reductions, we cannot help but wonder if the newfound frugality will apply to Messer. Dell, too?

The Company spent more than $990,000, $880,000, and $$650,000 in FY 2006, 2005, and 2004, respectively, on Dell’s personal and residential security.

Initially, Dell took his egress in March 2004, but retained his title as Chairman of the Board. In this titular role, the PC maker paid to him cash/bonus of $2.8 million and $3.2 million in FY 2006 and 2005, respectively.

In the last 2 ½ years, the share price of Dell lost about 27.5% in value. That is “disappointing and unacceptable,” too!

Upon his return, Messer. Dell said the Company was “halting staff bonuses” for 2006.

Shareholders might ask if the definition of ‘halt’ includes ‘other’ types of compensation, such as restricted stock awards (RSUs).

The granting of RSUs is a ruse often employed by crafty companies (with ‘no-bonus’ policies) to compensate key executives. For example, Jay S. Sidhu, the $900,000 Chairman and CEO of Sovereign Bancorp (SOV-$25.61) was not eligible for, and did not receive, a Tier I bonus of $750,000 in cash (as stated in his employment agreement) because the bank “did not meet the predetermined target of $1.93 in operating earnings per share for 2005.” Nonetheless, Sovereign granted to Messer. Sidhu stock units valued at $1.81 million and $1.41 million for FY 2006 and 2005, respectively.

“We have a tough couple of quarters ahead," said Dell in his memo. "We didn't get here overnight and we won't fix things overnight either."

If history is a guide, the ‘tough couple of quarters’ will not apply to Dell himself.

Editor David J Phillips holds no financial interest in any of the stocks mentioned in this article.

This posting was reprinted with the expressed permission of Investor-Advantage: a new website dedicated to providing an educational forum for investment ideas.

As a freelance journalist, David pens two columns a week for Investor-Advantage: (1) Monday—a blog on all things ‘naughty’ about corporate insiders (corporate governance); and (2) Sunday—a three page newsletter with its finger on the market pulse: news and commentary, Wall Street rumors, and SEC filings.

1 comment:

So the idiot above is on a first name basis with Michael Dell. Maybe Mr "richard at Dell) may want to provide his last name so we can see what his agenda really is.

I love it when people come out to defend executives on a first name basis, ala "Steve" at apple, to try and make it sound like you have a relationship with them.

Funny that none of you executuives made any mention of increasing bureaucracy while you were all getting handsomely paid to duplicate each others jobs. Which, by the looks of your re-organization, looks like most of made out like bandits while accomplishing nothing that would merit and increase in pay or stock. But lets put a stop to the enrichment of the common employee because, afterall, did they not do what you told them? Sorry you were too busy worrying about Mr. Dell's security.....

Cheers,

M

Post a Comment