RadioShack Corp. (RSH-$18.50) Executive Chairman Leonard Roberts will retire after the May 18 shareholders’ meeting, the electronics retailer said Wednesday.

Under the consulting agreement, which was signed in 2005 when Roberts transitioned from chairman, CEO and president to executive chairman, he will earn $41,667 a month for 31 months, the company revealed in recent filings with the SEC.

In addition, during the term of the Consulting Agreement, RadioShack has agreed to provide Mr. Roberts with an administrative assistant and office space for him and his administrative assistant, selected by him but at a location other than RadioShack’s corporate headquarters. RadioShack will pay up to a total of $100,000 a year towards the cost of the rent and parking for the office space and the cost of Mr. Roberts’ administrative assistant’s base annual salary.

Strengthening demand for high-end electronics such as flat-panel televisions and MP3 players have lifted the shares of competitors Circuit City (CC-$26.65) and Best Buy (BBY-$56.90) to 52-week highs. Meanwhile, RadioShack is bouncing of its 52-week low, abandoned by investors, as analysts cite the absence of any cogent “merchandising strategy.”

At December 31, 2005, RadioShack operated 4,972 company-operated stores under the RadioShack brand, located throughout the United States, as well as in Puerto Rico, and the U.S. Virgin Islands. These stores are located in major shopping malls and strip centers, as well as individual storefronts. Each location carries a broad assortment of both private label and third-party branded consumer electronics products, including wireless telephones; residential telephones, DVD players, computers and direct-to-home satellite systems; home entertainment, wireless, imaging and computer accessories; and digital cameras, radio-controlled cars and other toys, satellite radios, memory players and wellness products.

The consumer electronics retail business is highly competitive, primarily driven by technology and product cycles. Principal competitors include consumer electronics retailers Circuit City and Best Buy; department and specialty stores, such as Sears and The Home Depot (which compete on a more select product category scale), and mass merchandisers such as Wal-Mart and Target.

According to management, RadioShack’s core-competence is grounded on three building blocks: (1) the extensive physical retail presence with convenient locations throughout the United States. (2) A specially trained sales staff capable of providing cost-effective solutions for customers’ routine electronics needs and distinct electronics wants, assisting customers with service activation, when applicable, and assisting with the selection of appropriate products and accessories. (3) The ability to accelerate the adoption rate of new technologies. To be blunt—no wonder RadioShack’s ship is listing—none of these integrant elements is unique to RadioShack!

RadioShack’s business strategy is to offer a “cost-effective solutions to meet everyone’s routine electronics needs and families’ distinct electronics wants.” Sadly, as witness to the Company’s deteriorating fundamental outlook, management has failed—(26,310) shareholders and customers alike—in identifying emerging growth opportunities [keeping stores stocked with the correct merchandise] and leveraging its assets and distribution network to create new streams of revenue and profit.

To be blunt—this management team is clueless! RadioShack has lost relevance to many a consumer electronics shopper. When was the last time you went to RadioShack looking to buy a new flat-panel television or an MP3 player? If readers are like us, on a shopping trip to other stores in the mall, you stumbled upon a RadioShack store and decided to stop in to buy some batteries or to play with their electronic toys.

RadioShack reported an approximate five percent rise in sales year-over-year to $5.1 billion in 2005, while net income fell 22.2% to $267.0 million [despite an effective income tax rate of 16.0% for 2005 versus 37.8% for 2004]. Comparable store sales grew an anemic 1.0% versus 2004.

At year end 2005, Total Debt as a percentage of Total capitalization jumped 870 basis points to 47.6%; tangible book value lost $1.47 to $4.36 per share; and return on equity and return on assets fell 460 basis points and 290 basis points, respectively, to 35.3% and 11.3 percent.

Cash flow from operating activities was a healthy $362.9 million. Free cash flow, defined as cash flows from operating activities less dividends paid and additions to property, plant and equipment, was $158.5 million in 2005, up from $83.4 million in 2004.

In February 2006, management announced a turnaround strategy with three end-objectives: (1) increase the average unit volume of its store base; (2) “rationalize” the corporate cost structure [does this include senior executives’ salaries/bonuses?]; and, (3) grow profitable square footage in the store portfolio [ed. note. The average store size was 4,972 square feet in 2005, down from 5,121 in FY ’03.]

This envisioned turnaround has four components:

· Store Rationalization. It is anticipated that the number of RadioShack company-operated stores will decline by approximately 400 to 700 stores through the first half of 2007. The Company expects that the costs of these closures will total approximately $55 million to $90 million. Corporate does expect, however, that the closures will result in a net positive future cash flow.

· Update inventory [translation: stock shelves with merchandise that customers will buy]. Corporate has identified a significant amount of slow-moving inventory for replacement. Management expects to incur additional inventory-related charges of approximately $5 million to $10 million during 2006. These charges, if incurred, would increase cost of products sold and adversely impact margins accordingly.

Stock turnover in 2005 and 2004 was constant at 135 days (versus 47 days and 69 days for Best Buy and Circuit City, respectively). Ultimately, the Company anticipates that this inventory update will help to increase the average unit volume of its store base. The average sale per ticket was $34.51 in 2005, up $0.67 from the prior year.

Wireless (which includes wireless handsets and communication devices such as scanners and two-way radios), accessories (home entertainment products, wireless handsets, digital imaging products and computers), and personal electronics (digital cameras, camcorders, toys, wellness products, digital music players and satellite radios) contributed 34.3%, 20.5%, and 14.7% to net sales, respectively, in FY ’05. [ed. note. Batteries and chargers contributed 6.5% to net sales in 2005!]

· Distribution Center Consolidation. Management intends to close its distribution centers in Charleston, South Carolina, and Southaven, Mississippi, in 2006. Management anticipates that total charges for consolidation will total approximately $4 million. Again, corporate expects that the consolidations will result in a net positive future cash flow.

· Reduce Overhead Costs. SG&A expenses in 2005 rose 70 basis points to 37.4% as a percentage of sales compared to the prior year. The dollar increase for 2005 was primarily due to an increase in payroll and commissions’ expense, plus rent expense.

Company-operated store sales per labor hour fell $1.24 to $80.00 compared to 2004.

In our opinion, competitive pressures will continue to dampen margins. Ergo, success in RadioShack’s turnaround strategy is highly dependent on driving average unit volume sales higher and containing internal cost structures.

Going forward, just in case the Company fails to improve its financial results, corporate has already come up with innovative defenses. Listed in its 10-K filing with the SEC as as being material:

- If severe weather, such as a large hurricane, tornado or earthquake, occurs in a particular region and damages or destroys a significant number of stores in that area, overall sales would be reduced accordingly [ed. note. The 10Q Detective calculated that 380 stores, or 9.1% of the Company’s total stores/kiosks were located in “Hurricane Alley”—Florida up North Carolina].

- The potential for future terrorist attacks, the national and international responses to terrorist attacks, and other acts of war or hostility could cause greater uncertainty…. these events could cause or contribute to a general decline in equity valuations, which, in turn, could reduce the market value of RadioShack.

Getting back to Mr. Roberts for a minute—as he was at the helm when RadioShack’s ship was battered by its financial squall--the 10Q Detective questions what ‘value’ he could possibly bring to the Company as it refurbishes itself on dry-dock? The Company responds that Mr. Roberts will focus on industry, civic and philanthropic activities for the company.

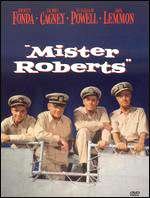

Mr Roberts—the 10Q Detective finds ironic parallels to the movie of the same name. Mr. Roberts—the movie released in 1955—starred Henry Fonda in the title role. A cargo officer and second in command on a supply ship during World War II, the easygoing Lt. Roberts is excluded from a much desired combat role. Instead, he plays second fiddle to the elaborate pranks of Ensign Frank Pulver (Jack Lemmon) and his younger crew. The young crew tries every available means of killing boredom, including eyeballing the nurses on a nearby island through a telescope, and Roberts does what he can to get them the R&R they badly need....

Our Mr. Roberts, now in retirement—and away from the corporate battles, both in the boardroom and in the field, is given similar gladhandling duties to justify his new paycheck.

Ironically, the movie got better reviews than RadioShack is getting now.

In conclusion, the 10Q Detective applauds RadioShack for its focus on rationalizing its cost structure. Our concern, however, remains the same: management’s acumen in identifying high-margin product winners. The flat panel business forms the backdrop fueling top-line growth at peer rivals like Best Buy and Circuit City. Prices for big-screen televisions are starting to drop—which means margins are falling, too. Going forward, RadioShack will need more than flat-panel sales to tip its EPS lever.

Granted, from a valuation perspective, RadioShack looks attractive, selling for only 12 times forward 12-month consensus 2007 EPS estimates of 1.53 per share (versus the Electronic Store Industry P/E 19 multiple). It would not surprise us to hear talk of an LBO, too.

Sadly, given so many hints being dropped by management that this transitional year will probably yield erratic financial performance, the 10Q Detective prefers to put RadioShack on our “Watch” list, for we do not see any catalysts [save for buyout rumors] driving the stock price higher--for now.

3 comments:

Thanks for the great work on your blog and a fresh perspective. On the RSH topic-usually somebody will come in (LBO,Private Equity, Eddie Lampert) and straiten the sinking ship. What about the real estate angle (similar to SHLD)?

you realize that you publish some of the best stock research on the WEB, right?

the bottom line is that the majority of RadioShack's businesses are watching their revenue crumble. RadioShack is increasingly depending on one revenue path. In the home electronics segment, that's a recipe for disaster, and the stock price has certainly reflected it......

Post a Comment