On March 29, 2006, citing competition from private label brands, the 10Q Detective warned our readers that—contrary to corporate prouncements—we did not believe that Spectrum Brands would see any meaningful top-line growth in their

battery business.

battery business.The 10Q Detective also expressed concerns that management activities (disclosed in Spectrum’s recent proxy statement) flashed a warning that management was more interested in egocentric than shareholder concerns.

Foreshadowing potential problems, too, were to be found in a recent posting [on footnoted.org] by our good friend, Michele Leder, on “alleged creativeness by Spectrum’s management with its five-year [price] performance in the DEF 14A filed with the SEC.

To our readers who were also erstwhile shareholders, glad that Michele and we could be of value!

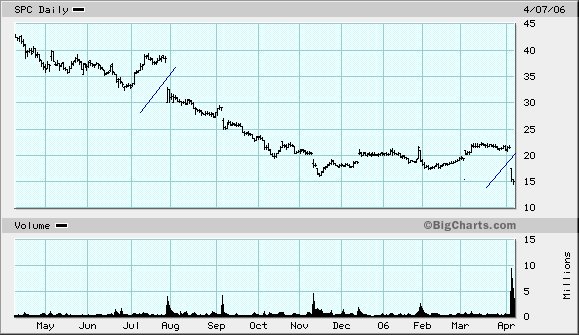

Battery maker Spectrum Brands (SPC-$15.00) fell to a new 52-week low Friday after the company slashed its second-quarter earnings forecast.

On Thursday, Spectrum lowered its quarterly guidance to net income between 3 cents and 6 cents a share, citing weak battery sales in North America and Europe. The company previously forecast profit of 35 cents to 40 cents per share. Analysts expected 37 cents a share, according to a Thomson Financial poll.

Spectrum also said it continued to be pressured by commodity costs. Spot prices of zinc, a primary component in making batteries, doubled over the last 12 months, and jumped more than 10 percent in the last month, the company said. Spectrum expects the trend of high zinc prices to continue.

Corporate forecasts on the forward price of zinc is one of the few statements made by Spectrum that the 10Q Detective can embrace as truth. Today, on the London Metals’ Exchange, zinc powered to a new high, topping $2,872.50 per metric ton. Commodity analysts predict that fundamentals and overall bullish momentum make $3,000 per metric ton an attainable target.

The 10Q Detective previously said that current management only knew how “to spend” its way to growth via acquisitions. Given that both Moody’s and S&P are reviewing Spectrum’s credit rating for possible rate cuts, future-buying sprees will be more costly.

Readers who heeded our advice and sold-short the stock on March 29 are sitting on a 29.4% gain. The Company stepped in its own “doo-doo,” and we se the stock slide continuing.

We only see a short-term price rebound if management takes action to unload the albatross around its collective neck—the battery business. HOLD SHORT POSITION.

Foreshadowing potential problems, too, were to be found in a recent posting [on footnoted.org] by our good friend, Michele Leder, on “alleged creativeness by Spectrum’s management with its five-year [price] performance in the DEF 14A filed with the SEC.

To our readers who were also erstwhile shareholders, glad that Michele and we could be of value!

Battery maker Spectrum Brands (SPC-$15.00) fell to a new 52-week low Friday after the company slashed its second-quarter earnings forecast.

On Thursday, Spectrum lowered its quarterly guidance to net income between 3 cents and 6 cents a share, citing weak battery sales in North America and Europe. The company previously forecast profit of 35 cents to 40 cents per share. Analysts expected 37 cents a share, according to a Thomson Financial poll.

Spectrum also said it continued to be pressured by commodity costs. Spot prices of zinc, a primary component in making batteries, doubled over the last 12 months, and jumped more than 10 percent in the last month, the company said. Spectrum expects the trend of high zinc prices to continue.

Corporate forecasts on the forward price of zinc is one of the few statements made by Spectrum that the 10Q Detective can embrace as truth. Today, on the London Metals’ Exchange, zinc powered to a new high, topping $2,872.50 per metric ton. Commodity analysts predict that fundamentals and overall bullish momentum make $3,000 per metric ton an attainable target.

The 10Q Detective previously said that current management only knew how “to spend” its way to growth via acquisitions. Given that both Moody’s and S&P are reviewing Spectrum’s credit rating for possible rate cuts, future-buying sprees will be more costly.

Readers who heeded our advice and sold-short the stock on March 29 are sitting on a 29.4% gain. The Company stepped in its own “doo-doo,” and we se the stock slide continuing.

We only see a short-term price rebound if management takes action to unload the albatross around its collective neck—the battery business. HOLD SHORT POSITION.

No comments:

Post a Comment