Precision Drilling Trust (PDS-$28.30) is the leading provider of energy services to the Canadian oil and gas industry.

Income-oriented investors might want to take a look at Precision Drilling, for it is an open-ended investment trust that makes monthly cash distributions. The estimated dividend yield for FY 2006 is about 12 percent. The Trust holds a 99.12% interest in Precision Drilling Limited Partnerships (which owns Precision Drilling Corp.).

Company Overview

Precision’s operations are reported in two segments. The Contract Drilling Services segment—which comprises the foundation of the Company’s oilfield services enterprise (about 77 percent of operating profits)—includes contract drilling rigs, camp and catering (LRG Catering), oilfield supply, and manufacturing divisions. The Completion and Production Services segment includes well servicing (for completions, workover, maintenance and abandonment work on any well), wastewater treatment units, rig-assist snubbing (for under-balanced drilling), and rental divisions.

Precision is Canada’s largest drilling contractor with a 30 percent market share and a modern fleet that consists of 234 rigs covering depth ranges from a few hundred meters to almost 6,700 meters.

Precision dominates in the Western Canada Sedimentary Basin (WCSB). The WCSB has a complex mix of energy reserves—oil sands, heavy oil, conventional oil, coal bed methane, deep gas and shallow gas—as well as challenging geography and ever-changing weather conditions. As the basin matures, Precision is able to offer its customers greater efficiencies and “best-of” technology through the provision of a diversified inventory of oil-service equipment and a highly qualified and experienced technical staff.

Precision has a balanced drilling rig portfolio, with a particular strength in deep drilling. As customers turn to deeper wells to discover new reserves, Precision’s 40 percent market share in rigs with a depth capacity greater than 3,600 meters is noteworthy. Drilling opportunities for natural gas reserves is a market where the Company has an advantage, a market many expect to emerge in Canada.

Financial Overview

For the six months ended June 30, 2006, earnings from continuing operations were $312.5 million on revenue of $759.9 million, as compared to $97.6 million on revenue of $541.3 million in 2005. The 1H:06 benefited from a combination of higher equipment utilization (in part due to dry weather conditions) and continued strong pricing in both the Contract Drilling and the Completion and Production business segments.

Net earnings per unit share were $2.49 in the 1H:06 compared to $1.32 in 2005. A lower effective tax rate (as Precision converted to a Trust in November 2005) and substantively enacted tax rate reductions contributed to an increase of $0.81 per unit in the 1:06 over the same period last year. The effective income tax rate in the 1H:06 was about 8 percent compared to 37 percent last year.

In the 1H:06, the Company had a dividend payout ratio of 68.3 percent, declaring $1.70 in distributions per unit share.

Precision’s liquidity and financial health remains strong, as working capital exceeded long-term debt and other liabilities by $83.7 million at June 30, 2006. Long-term debt stood at $45.0 million, for a long-term debt to long-term debt (plus equity ratio) of 4.0 percent.

Growth Initiatives

Accretive growth is being delivered organically through the addition of new equipment lines across the organization and geographic expansion into other North American markets. Growth is anticipated, too, from value-added acquisitions.

Precision Drilling is moving forward on several growth initiatives:

1. The geographic expansion of Precision’s Contract Drilling services segment to the United States is proceeding as planned. A drilling rig commenced work in Texas in late June 2006. Plans to construct an additional 10 drilling rigs for the U.S. market is proceeding on schedule. Precision expects to have a fleet of 11 drilling rigs operating in the U.S. by the end of the second quarter of 2008.

2. By the 4Q:07, Precision expects to have a fleet of 252 drilling rigs operating in Canada, up from the 2Q:06 end count of 234.

3. The Completion and Production Services segment has initiated several growth measures for its domestic market. The Service Rig unit secured a long-term customer commitment to construct two slant service rigs for the heavy oil market.

4. By the 1Q:07, the Company’s Production Services segment expects to be operating a fleet of 239 service rigs compared to a current fleet size of 237.

5. In addition, the snubbing unit division has initiated plans to construct four new stand-alone units, of which two will be a rack and pinion design. By the end of the 3Q:07, Precision expects to be operating a snubbing fleet of 30 units.

6. In August 2006, Precision acquired Terra Water Group Ltd., an Alberta based company that operates 40 wastewater treatment units for the traditional drilling rig camp market in western Canada

Valuation Analysis

The oils-service industry has been in a freefall since May, as investors fled the stocks in the belief that declining energy prices meant that the current cycle in drilling activity was peaking. The Philadelphia Oil Service Sector Index (OSX) has slipped 20.2 percent in the last five-months.

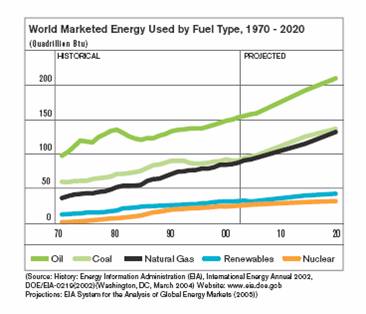

Our forward view remains that energy prices will stabilize, and possibly turn higher, for a supply imbalance (where field depletion rates outstrip new reserve additions) will put a floor on commodity prices and precipitate the continuing need for exploration and drilling activity.

Albeit oil and gas prices have slipped, they still remain high relative to historical benchmarks. West-Texas Intermediate (WTI) oil prices averaged US ($) 56 per barrel during 2005, an increase of 37 percent over the 2004 average of US ($) 41 per barrel.

North American natural gas prices are also being supported by strong fundamentals (as older, shallow wells are being depleted). North American Henry Hub natural gas prices surged 45 percent in 2005, averaging US ($) 8.96 per mmbtu, an increase of US ($) 2.78 per mmbtu over 2004. Demand for natural gas is increasing with economic activity while the supply from relatively mature basins is continuing to decline.

Industry fundamentals remain strong in Canada. Although the Canadian Association of Oilwell Drilling Contractors has decreased its 2006 industry well count forecast from 26,070 to 23,827 wells, it has increased its estimate of average drilling rig operating days per well assumption from 6.4 to 7.2 days. This results in a net increase of 3 percent in the forecast industry operating days for 2006 from 166,849 to 171,489 days.

On a valuation basis, Precision Drilling is selling at for a forward 12-month P/E multiple and trailing EV/EBITDA of 8.73 times and 5.90 times, respectively. The Common Stock is selling at a discount to its peers: Schlumberger Ltd. (SLB), 16.68x and 14.03x; Baker Hughes Inc. (BHI), 13.55x and 10.54 times; and, Nabors Industries Ltd. (NBR), 6.42x and 7.19 times, respectively.

Precision offers attractive growth prospects (and income) for value-oriented investors and a “bounce” trading opportunity for speculators (the stock has slipped about 23 percent in price since early May).

For traders, the catalysts for a positive shift in investor sentiment could be a colder-than expected winter in North America and a firming in energy prices.

Investment Risks and Considerations

Financial performance in the oilfield service industry in Canada is subject to seasonal trends. The first quarter is usually the most active and prosperous as winter ground conditions typically allow complete access to well locations [frozen lakes and compacted snow make for good roads]. In the second quarter, spring weather (rain) softens ground conditions and can slow oilfield service activity dramatically. Subject to dry weather, activity resumes and will sequentially gain momentum in the third and fourth quarters.

Volatility in oil and natural gas prices can impact Precision’s customers’ activity levels and spending for its products and services. While current energy prices are important contributors to positive cash flow for its customers, expectations about future prices and price volatility are generally more important for determining future capital spending levels. For example, almost three-quarters of the drilling activity in western Canada is targeting natural gas reservoirs, making this activity the primary driver of demand for Canadian oilfield services. A continued decline in natural gas prices could lead to capital spending cuts by the customers—with a resultant slowdown in demand for Precision’s products and services

Precision operates in a highly competitive environment, which may adversely affect the Company’s ability pricing power (e.g. rig rates).

Editor David J Phillips is long shares of Precision Drilling Trust but has no financial interest in any other company mentioned in this posting. The 10Q Detective has a full disclosure policy.

7 comments:

David,

Why do you list BHI and SLB as peers? They are diversified service providers, whereas PDS does rigs only. I think Nabors is the only true comp, and it seems to be in-line with NBR. Comments?

PDS is looking to organically grow beyond rig servicing--ergo wanted to show readers what company might be worth if growth accelerates

I assume you are refering to the following ancillary comments made by management during their Third Quarter Earnings Release:

http://biz.yahoo.com/iw/061026/0177173.html

"To close out the third quarter, 1,784 new well licenses were issued in September, the lowest industry total for that month since 2002.

Precision's drilling rig activity to this point in October is averaging 48% operating day utilization compared to 68% in the fourth quarter of 2005. Wet weather in October is contributing to the decline and the weakness in natural gas pricing has impacted the urgency with which customers are approaching their upcoming winter drilling programs. In contrast to last year, there is more rig availability for the spot market and bidding for contracts has become more competitive.

"Natural gas accounts for about 70% of Precision's activity in Canada and the drop in prices has slowed down drilling but the one-year forward strip on gas prices remains respectable," said Mr. Stahl. "What we are seeing is movement away from drilling shallow gas wells to deeper targets and a shift in our equipment utilization to our deeper rigs."

In my view, these comments were not unexpected--given the swift decline in energy prices in the last quarter. The stock has declined more than 35% in the last 52-weeks--so in some respects, the odds of a decline in future monthly payouts has been discounted by the market.

Yes, the Company's dependence on Natural Gas is a concern, but there is no reason to panic sell, for I am in the camp that a cold winter in the NE will quickly correct fundamental price declines.

I do not know what price you paid for PDS, but I see no reason to sell--unless you need to offset LT capital gains?

Well it looks like there might be some panic selling today!

I can't find any news to spark this recent selling.

Anybody know anything?

A proposal by the finance minister of Canada, Jim Flaherty, to tax income trusts (to stem declines in government revenue) is the cause of the recent selloff in PDS and other Royalty Trusts:

Considerations:

1. Flaherty's proposal runs contrary to his party's "no-tax" campaign.

2. Existing trusts like PDS would not feel the full brunt of the tax until 2011.

3. The slide in the price of the energy & energy services trusts might make some of these companies attractive as takeout candidates.

4. To make this tax "stick"--proposal will probably be 'watered down.'

5. Potential negative(s)include: Taxing Dividends means less income to investors (esp. foreigners) & means affected Trusts will have to "rethink" dividend payout ratio-to-CAPEX budgets.

How will the new legislation be "watered down"? Either the company exists as an Income Trust or it doesn't. I don't see the middle ground that you are implying.

I really enjoy your blog. Well written.

In a meeting with energy executives, Canadian Finance Minister Jim Flaherty repeated on Tuesday that he would not consider exemptions for the sector from a new tax on income trusts. However,

Flaherty did leave a tiny opening for those who have made the case for additional tax measures that could help income trusts in the future. Some have suggested that existing trusts should be able to convert back to corporations when the new tax comes into effect in 2011 without being penalized.

[Reuters]

Contrary to Flaherty's comments--in politics--everything is subject to 'negotiation.'

Post a Comment