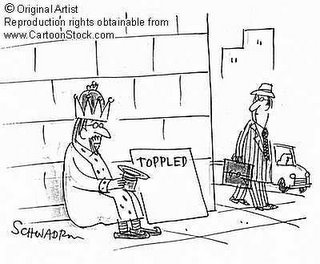

The news that the Board of Directors of struggling, open-source software developer Novell, Inc. (NOVL-$6.66) ousted CEO Jack Messman and CFO Joseph Tibbets was met with applause by investors, as the stock was bid up 11.0% in the last two trading days.

Erstwhile owner of WordPerfect and the Quattro Pro spreadsheet, Novell in recent years has struggled in finding a sustainable—and profitable—growth strategy.

In July 2001, Jack L. Messman became Chief Executive Officer of Novell in connection with Novell’s acquisition of Cambridge Technology Partners, Inc. Embracing the open-source movement, Messman built—through acquisitions—a Company that supported a full range of enterprise solutions on the Linux platform, from the desktop, to the server, to the mainframe. Open source is a term used to describe software source code that generally allows free use, modification, and distribution of source code.

Despite a market for Linux (open source) products and services growing at an overall rate of approximately 26 percent per year through 2008, Novell (under the tutelage of Messman) lagged behind. Hobbled by delays in the introduction of new products, declining revenue streams from legacy products (such as Netware), and an inability to execute on its market plans, year-over-year net revenue in 2005 and 2004 grew an anemic three percent and five percent, respectively.

Software competitor, Red Hat, Inc. (RHAT-$26.67), reported that 12-month sales for the year-ended February 28, 2006, jump 41.7% compared to the prior year. And, manufacturers and vendors who work with Red Hat expect business to grow by at least 31 percent in FY 2006.

According to an October 2005 BusinessWeek article, Red Hat had 63% of the Linux server market share in 2004, compared with just 20% for Novell.

After two years of Board indifference to shareholder grumbling that Messman was too slow to cut costs (including a bloated R&D department), divest non-core businesses, and was losing [unwarranted] market share to the likes of Red Hat, Novell has finally installed a new Commander-in-Chief. Promoted to be the new CEO is Novell's current president, Ronald Hovsepian.

In a morning call with analysts, Hovsepian pledged, “to accelerate growth.” Analysts speculate [that aside from slashing costs and other restructuring moves to give a bounce to short-term profits] the new CEO will look to acquire a fast-growing open-source software distributor or startup. As of April 30, 2006, the Company had approximately $1.3 billion, or $3.95 per share, in cash.

What of the Messman Legacy? When he started as CEO on July 10, 2001, the Common Stock of Novell traded at $4.87 per share. On July 21, 2006, the Common Stock traded at $6.00. An investor could have received a higher return on invested capital by buying a 10-year Treasury note in July 2001, which yielded approximately 5.5 percent.

Albeit shareholders have suffered, a look at Jack Messman’s employment and severance agreements reveal the quintessence of absurdity:

- Upon his initial employment, Mr. Messman received options to purchase a total of 2,408,045 shares of Novell’s common stock at a purchase price of $5.02 per share (all fully vested now) and the right to purchase 715,780 shares of restricted common stock for a purchase price of $.10 per share.

- As of February 28, 2006, Messman beneficially owned 1.56%, or 6.2 million shares of the Common Stock of Novell, worth an estimated $41.29 million. He currently owns 804,406 shares of Common Stock with the right to acquire an additional 5.3 million shares (this latter amount includes shares that can be acquired through stock options that are exercisable through April 1, 2006). According to his updated Severance Agreement (dated January 7, 2005), none of these shares revert back to the Company.

- If Messman, 63, should choose not to retire, the Company is obligated to spend up to $190,000 on executive “outplacement services.” Mr. Messman is currently on the Board of Directors of RadioShack Corp. (RSH-$14.39), where he earned $40,000 last year [He also has a discount card that entitles him to receive a 30% discount on all RadioShack-branded merchandise and a 10% discount on branded merchandise purchased at RadioShack stores.] and Safeguard Scientifics, Inc. (SFE-$2.30), where he earns an annual retainer of $35,000. [ed. note. These annual retainer figures exclude additional compensation for Board meetings, committee attendance(s), and stock units awarded to him.] He is also a Director at Timminco Limited (TIM.TSX-$0.28), a Canadian manufacturer and supplier of engineered magnesium extrusions. In other words, he has plenty to do to keep him busy when he steps down from the Board of Novell come October 31, 2006.

- As a result of his “involuntary termination,” Messman is entitled to receive 150% of his Base Pay, or approximately $1.43 million (in installments or in a lump sum).

Even on his way out the door, Messman is still making Novell bleed. For making a real “mess, man,” Jack Messman arranged a favorable severance for himself.

Just to rub some salt in the wound—Messman’s & existing shareholders’—the 10Q Detective thought it prudent just to make mention of the perquisites that the former CEO will have to leave behind:

- In FY 2005 and FY 2004, personal use of Novell’s corporate aircraft that was valued at $137,711 (valued at the incremental cost to the corporation) and $54,615 (valued using Standard Industry Fare Level (“SIFL”) rates from the U.S. Department of Transportation), respectively. For FY 2005, there is another $34,000 listed in ‘Other Annual’ compensation that is not broken out in detail.

- Despite dismal leadership and corporate performance in FY 2005, the Board had granted to Messman a cash bonus of $625,000 and the right to purchase 1,551,528 shares of stock (at an exercise price of $6.67 per share).

As an investment, once the stock price retraces some of its recent optimistic gains [the “Messman Ouster” effect), investors might want to take a look at this new day at Novell, Inc. More than one pundit has repeatedly said that market dynamics support—and need—a counterweight to Red Hat. Computer makers Hewlett-Packard, Dell, and IBM—these are three among many OEM that are looking for choice in [Linux] suppliers.

Additionally, the Company does have products lauded by many in the software industry as best in class. For home office computing, SUSE Linux 10.1 features an easy-to-install Linux operating system that lets users browse the Web, send e-mail, organize digital photos, play movies and songs, and create documents and spreadsheets. And, the Company’s security and management suite of products have won industry awards for “Best Enterprise Security Solution.”

Investors can buy in to a company that sells for only two times book [which does not reflect current valuation of real-estate assets] and a trailing twelve-month enterprise value–to- revenue of 1.31, compared to Red Hat’s P/B and P/S of 10.04x and 16.78x, respectively.

1 comment:

Looks like Jack learned how to hose the company from his buddy Len Roberts at RadioShack.

Despite the Shack tumbling from north of $70 a share a few years ago to just south of $14.99 Roberts left RS with a handy chunk of change, a fully paid office, parking and a secretary .... all on the basis of being a Shack goodwill ambassador.

Roberts is the same guy who told employees a couple of years ago that his hand picked successor, Dave Edmondson, was "ready" for the job of CEO. Edmondson was recently convicted on a DWI related charge and is working off his 30 day jail sentence on the labor squad for Tarrant Co. inmates. Under Edmondsons leadership sales and share price crumbled during 2005.

The RadioShack B.O.D. of which Messman was a member routinely approved every hair brained scheme Roberts and Edmondson came up with to improve RadioShack sales. They failed the due diligence test by not vetting Edmondson before appointing him CEO. Edmondson lied on his resume claiming degrees he never earned.

Furthermore, the BOD of RadioShack is supposed to name a new CEO by mid year. Well mid-year has arrived and is almost gone. The rubber stamping BOD, with Messman a member, has yet to make an announcemnt.

The interim CEO Claire Babrowski is doing a yeomans job in shoring up employee moral, plugging leaks of revenue all over RadioShack. She is doing the job but is hamstrung by the BOD's lack of action.

Since so many of the RadioShack BOD's are Len Roberts cronies, and approved Edmondsons succession they may be scared to death to make an honest to Pete business decision - one that may actually result in one or more getting canned.

Messman certainly did a crappy job at Novell, and continued his style as a BOD member at the Shack.

Post a Comment