G&K Services Inc. (GKSR-$34.65), one of the nation’s biggest uniform-rental companies, announced last Friday that it would freeze the defined benefit pension plan for its 6,300 employees, effective December 31, 2006. The Company joins a growing list—IBM, Verizon, and Circuit City Stores—of financially healthy firms that have moved to freeze pension obligations as they seek to shift the burden of retirement savings to employees.

According to the Employee Benefit Research Institute, the number of active, private-sector workers covered by defined-benefit plans has been on the decline for some time. The number of PBGC-insured plans peaked at more than 114,000 in 1985, declining to 31,238 in 2004.

“The burden of funding defined benefit plan obligations is a hurdle that challenges even financially secure companies like G&K in strengthening their market position," said Richard Marcantonio, Chairman and CEO.

In G&K’s press release last Friday, CEO Marcantonio, noted that in recent years, financial and legislative pressures on defined benefit plans have mounted and the funding costs have become increasingly volatile and unpredictable. On the former comment, the 10Q Detective and Mr. Marcantonio can agree— long-term, comprehensive reforms are needed to strengthen corporate America’s Defined-Benefit Pension System(s).

In the last two years, Congressional subcommittees have held hearings on how to better protect employee benefits in Corporate America. Areas of reform under discussion include making permanent changes to the interest rate companies use to calculate their pension liabilities, improving transparency by enhancing disclosure for participants, and reforming pension funding rules (e.g. raising funding limits).

In "The Critique of the Gotha Program” Karl Marx elucidated his much repeated bromide: “to each according to his labor contribution.” Just as in communist countries, however, history has shown that the burden of change always seems to more adversely affect those not making the decisions.

The changes at G&K will not affect the $13.9 million in projected benefit obligations owed to past—and present senior management members—under the Supplemental Executive Retirement Plan (SERP). Nor will the burden of funding this ancillary executive retirement plan go away. As of FY ending July 2, 2005, the Company’s SERP was under-funded by approximately $14.0 million.

Karl Marx would assert that only when society moves beyond “the sphere of bourgeois right altogether”—and ascends to a higher phase of communist society—only then will society operate according to the moral norm, “from each according to his ability, to each according to his needs.”

Has anyone ever seen a member of the Politburo of the People’s Republic of China riding a bicycle to a Committee meeting? The day that happens is the day that society moves beyond the sphere of bourgeois—and will be the day that management at G&K (and all companies) actually makes a fiduciary decision that adversely impacts their own perquisites and retirement benefits, too!

Pension fund freezes are a transparent ploy to cut costs and strengthen balance sheets (by limiting accrual of payment obligations). G&K did not disclose the expected savings that will result because of their maneuver; nonetheless, a review of G&K’s financial statements might provide a useful guide in assaying whether or not there is a value proposition to flash freezing future pension obligations?

[Ed. note. Readers concerned about spotting worrisome signs that their own pensions might be in trouble—perchance—can also pick up some identifying patterns from our review of G&K. The 10Q Detective also suggests linking to a recent online BusinessWeek article: Is Your Pension Plan Retiring Before You?]

G&K’s rental operations business is largely based on written service agreements whereby the Company agrees to collect, to launder and to deliver uniforms and other related products. The service agreements provide for weekly billing upon completion of the laundering process and delivery to the customer. Accordingly, revenue from rental operations is recognized in the period in which the services are provided. Revenue from rental operations also includes billings to customers for lost or abused merchandise.

Direct sale revenue is recognized in the period in which the product is shipped.

G&K Services, Inc., founded in 1902 and headquartered in Minnetonka, Minnesota, is a market leader in providing branded identity apparel and facility services programs that enhance image and safety in the workplace. The Company serves a wide variety of North American industrial, service and high-technology companies providing them with rented uniforms and facility services products such as floor mats, dust mops, wiping towels, restroom supplies and selected linen items. G&K also sell uniforms and other apparel items to customers through a direct sale programs. The North American rental market is approximately $6.5-$7.0 billion, while the portion of the direct sale market targeted by the Company is approximately $4.5-$5.0 billion in size.

Through internal growth and acquisitions, G&K has steadily expanded its operations into additional geographic markets. The Company operates over 140 locations in North America. These locations service customers in 86 of the top 100 markets, including all 30 of the top 100 markets in the United States and Canada.

In fiscal 2005, revenue grew to $788.8 million, up 7.5% over the prior year. Excluding the impact of a 53 rd week in fiscal 2004, full year revenues were up 9.5%. According to management, revenue growth was negatively impacted by lost uniform wearers due to reduced employment levels within the Company’s existing customer base, offset by an improved pricing environment and new account sales.

Rental revenue, which represented 93.9% of total net revenue, was up $32.0 million in fiscal 2005, a 4.5% increase over fiscal 2004 (96.6% of total net revenue). Rental revenue increased 6.4% when excluding the impact of an extra week recorded in fiscal 2004. This growth rate was impressive, considering that the organic industrial rental growth rate was approximately 0.5% (an improvement from negative 2.0% in the prior year period). According to management, improvements in customer retention and a better pricing environment were slightly offset by lost uniform wearers (due to reduced employment levels within its existing customer base).

Direct sale revenue was $48.1 million (6.1% of net revenue) in fiscal 2005, a 94.3% increase over $24.7 million (3.4% of net revenue) in fiscal 2004, largely due to the impact of the Lion Uniform Group. The organic direct sale growth rate was approximately 29.5%. The increase in the organic direct sale growth rate was largely due to garment sales through G&K’s rental operation including its annual outerwear promotion and large shipments at the direct sale unit to one customer.

Gross Margins fell 110 basis points in the past two years (to 35.9 percent). The decrease in gross margins was principally due to higher energy and acquisition integration costs in the current year, largely offset by the benefit of numerous operational initiatives focused on lower merchandise and production costs.

According to management, significant increases in energy costs, specifically natural gas and gasoline, can materially affect operating results. As of July 2005, energy costs represented approximately 4% of total revenue. The retail price of gasoline on July 4, 2005, was $2.46 per gallon (87-octane).

Operating margins have remained relatively stable, falling only 20 basis points in the last two years (to 9.6% of operations).

Selling and administrative expenses increased 7.3% to $165.8 million in fiscal 2005 from $154.5 million in fiscal 2003. As a percentage of total revenues, however, SG&A decreased to 21.0% in fiscal 2005 from 21.9% in fiscal 2003. The improvement as a percent of revenue was due to continued leverage on incremental revenue growth and investments in growth initiatives.

Selling and administrative costs include costs related to the Company's sales and marketing functions as well as general and administrative costs associated with the Company's corporate offices and operating locations including information systems, engineering, materials management, manufacturing planning, finance, budgeting, and human resources.

G&K’s SG&A expenses are competitive with other major North American providers of corporate identity uniforms, including UniFirst Corp. (UNF-$34.54) and Cintas Corp. (CTAS-$39.55), with SG&A of 21.4% (for the thirty-nine weeks ended May 28, 2005) and 26.4% (for the year ended May 31, 2005), respectively.

[Ed. note. Executive Compensation (Annual Compensation + Long-Term Compensation Awards + All Other Compensation) for the top five decision-makers at G&K contributed approximately $4.3 million for FY ’05, or 2.6%, of the reported $165.8 million in SG&A expenses in 2005. The Company paid out approximately $2.3 million in Executive Compensation in FY 2004, which contributed 1.4% to the $158.0 million expensed as SG&A that year. Do any of our readers see any fat in SG&A that could be cut from the budget to yield additional cost-savings?]

Of interest, despite net income rising thirty basis points in the last two years to 5.1%, net cash provided by operating activities has been falling—$63.5 million in fiscal 2005, compared to $96.3 million in fiscal 2004 and $96.9 million in fiscal 2003. Rising net income, but falling cash flow is a red flag. The Company attributes the decline partially to an $11.2 million growth in new inventories “in connection with the expansion of its manufacturing operations”—despite prior initiatives that focused on controlling the usage of ‘in-service’ inventory. Accounts payable and other accrued expenses also rose $16.3 million and cash was also negatively affected by the timing of tax payments.

G&K’s inventories consist of new goods and rental merchandise in service. For the FY ended July 2, 2005, year-over-year inventories grew $26.6 million to $121.1 million, the result of a $22.6 million increase in new goods (in connection with corporate expansion of its manufacturing operations).

The 10Q Detective is putting the spotlight on G&K’s inventory levels, for industry experience dictates that the useful life of uniforms is only eighteen months. Ergo, taking on additional “stocking costs” are just as relevant as incurring “stockout costs” (of too little inventory on hand).

G&K’s goods turned-over every 77.8 days, compared to 74.5 days in the prior year period. Management would attribute the slight rise in days outstanding to its ‘in-service’ initiative.

By comparison, Cintas, North America's leading provider of corporate identity uniforms through rental and sales programs, turned its inventory over every 47.2 days.

As previously mentioned, in its sale of customized uniforms, G&K competes on a national basis with other uniform suppliers and manufacturers, like Cintas and UniFirst. Additionally, G&K vies with a multitude of regional and local competitors that vary by market. Given an anemic sales environment (with single-digit top line growth), the 10Q Detective has spotlighted corporate initiatives focusing on the importance of reducing cycle times and operating costs (to leverage profitability). As such, G&K must look to supplement its internal growth with strategic acquisitions and the cultivation of new businesses.

Management’s goal is to build a national footprint and, accordingly, it is placing strategic value on acquisitions, which expand the Company’s geographic presence. And this takes money.

The 10Q Detective has unearthed ‘soft spots’ on G&K’s balance sheet that call in to question the Company’s financial integrity.

1. In August 2004, G&K acquired Keefer Laundry Ltd., a textile laundry company serving the Vancouver and Whistler areas of British Columbia. The acquisition extends the Company’s uniform and textile rental service area to Western Canada.

2. Nettoyeur Shefford Inc., a uniform and textile service company serving Granby and Montreal, Quebec was purchased in October 2004. This acquisition enhances the market position, serving customers in the province of Quebec.

3. Also in October 2004, G&K purchased certain industrial rental assets and customers of Marathon Linen, Inc., a uniform and textile service entity serving the Detroit metro area. This acquisition expands the geographic coverage to a major North American market.

4. In December 2004, the Company acquired the direct sale uniform group and related assets from Lion Apparel, Inc., a Dayton, Ohio based designer, marketer and distributor of customized uniform programs. This acquisition expands the direct sale business and positions G&K to pursue greater direct sale growth.

5. Custom Linen Systems, Ltd. was acquired in February 2005. Custom Linen Systems is a textile laundry company serving Calgary and Edmonton, Alberta. This acquisition expands the Company’s uniform and textile rental service footprint in western Canada.

6. In March 2005, G&K acquired certain assets from Coyne Textile Services. The Company acquired two processing facilities serving customers in Connecticut, New York, Pennsylvania and New Jersey, and also acquired certain customer assets in Maryland and Florida. This purchase expands and enhances the uniform and textile rental business in North America.

The total purchase consideration, including related acquisition costs of these transactions, was $86.8 million, $24.9 million and $88.7 million in fiscal 2005, 2004 and 2003, respectively. The fiscal 2005 purchase consideration includes $11.9 million of debt issued.

Working capital at April 1, 2006 was $142.4 million, up 37.2% from $103.8 million at July 2, 2005. However, subtracting inventories and pre-paid expenses of $137.2 million and $14.6 million, respectively, and current working assets shrink to $(9.4) million.

Adding to G&K’s potential liquidity problem is the sluggishness the Company has in converting its expenditures back into cash. G&K’s Cash Conversion Cycle is approximately 97 days.

At April 1, 2006, G&K had available cash on hand of $22.0 million and approximately $234 million of available capacity under its revolving credit facility when considering current outstanding borrowings and letters of credit. Corporate anticipates that it will generate sufficient cash flows from operations to satisfy its cash commitments and capital requirements for fiscal 2006 (and to reduce the amounts outstanding under the revolving credit facility); however, the Company has $140.5 million in fixed cash obligations (payments due on long-term debt, including capital leases) coming due in the next three years.

The 10Q Detective calculates that G&K’s defensive-interval ratio—which measures the time span a firm can operate on present liquid assets without mortgaging future revenues—was approximately 58 days. Ergo, we doubt that G&K will be able to simultaneously seek out new acquisitions, pay its daily expenses—and meet estimated capital expenditures in FY ’06 of $30 million to $35 million—without slashing costs somewhere on its books.

U.S. Film Director, Billy Wilder, was credited with saying: “Hindsight is always twenty-twenty.” Looking retrospectively at the financial statements of G&K Services, the red flags bringing attention to possible cash drains at the Company were easier to spot—as was an “I Told You So” percipiency that a flash freeze of its defined benefit plan was imminent.

G&K’s pension plan is a financial drain on the Company: G&K recognized expense for its defined benefit pension plan of $4.9 million, $6.1 million and $3.1 million in fiscal 2005, 2004 and 2003, respectively.

G&K shelled out $1.34 million to cover post-retirement employee benefits (PREB) for FY ‘05, an 8.4% increase over the prior year. In five-years (based on expected number of employees & aggregate years of future service), retirement plan payout benefits were expected to grow approximately 700 percent—to more than $10.3 million per annum.

[Ed. note. Pension liability and future pension expense increases as the discount rate is reduced. Corporate discounted future pension obligations using a rate of 5.50% at July 2, 2005. (The discount rate is determined based on the current rates earned on high quality long-term bonds.) Decreasing the discount rate by 0.5% (from 5.50% to 5.00%) would increase G&K’s accumulated benefit obligation at July 2, 2005, by approximately $4.1 million and increase the estimated fiscal 2006 pension expense by approximately $1.1 million.]

Some readers might ask—Would these cost-savings be eliminated by additional corporate contributions to G&K’s 401 (k)? All full-time nonunion employees are eligible to participate in the 401(k) plan. The Company matches a portion of the employee’s salary reduction contributions and provides investment choices for the employee. The matching contributions under the 401(k) plan, which vest over a five-year employment period, were $$1.81 million in fiscal 2005. The answer is no. Matching contributions are made in G&K stock—which is a non-cash entry to the Company

Additionally, the Company paid out $307,000 in SERP benefits to retired executives, a 15.8% increase over the prior year. In five-years, SERP benefit plan payouts are expected to rise 742.9% to $2.57 million per annum. [Ed. note. We do not expect the Company to freeze this ancillary executive perquisite.]

As of FY ended July 2, 2005, G&K’s pension liabilities were twice as much as its assets. In fact, the plan was under-funded by $(30.23) million. [That is the gap between the $(59.29) million obligation and the $29.06 in plan valued assets.]

Why the shortfall? Given that companies generally do not get tax benefits for contributing to the plans (and the gains are taxable), historically it did not make sense for G&K to close the deficit.

What impact did the plan have on FY ’05 net income? First, there was the $3.79 million in service cost (which was the present value of the future benefits earned by current employees during the year); then there was the $2.72 million in interest costs (on the projected benefit obligation).

An offset to the aforementioned costs is the Company ‘expected long-term rate of return’ of 8.0% (on plan assets), which lowered the expense by $2.17 million. [Ed. note. The expected long-term rate of return on plan assets at July 2, 2005 was based on an allocation of U.S. equities and U.S. fixed income securities. Decreasing the expected long-term rate of return by 0.5% (from 8.0% to 7.5%) would increase the Company’s estimated 2006 pension expense by approximately $0.1 million.] Hopefully our readers picked up on this ‘soft spot’—for the actual return on plan assets was a gain of a less-than-expected $1.89 million.

In the mix the Company also stirred $55,000 in prior service cost and a loss (unexplained in footnotes) of $514,000 and the 2005 period benefit cost totaled a previously mentioned $4.9 million!

In our opinion, because of pecuniary offenses endemic to G&K Services (and already discussed in this blog), freezing its pension plan will not give the Company any singular, competitive advantage over UniFirst or Cintas.

The 10Q Detective also believes that Cintas will flash-freeze its defined-benefit pension, too. The Company continues to be the target of a corporate unionization campaign by UNITE HERE and the Teamsters unions. In our opinion, should workers eventually say yes to union representation—look for the Company to say no to its pension plan.

As the economy has strengthened and employment rates have improved, the outlook for fiscal 2006 and FY ‘07 remains guardedly optimistic for all three uniform-rental firms. In our opinion, upward price changes in oil and fuel costs will continue to pressure gross margins; In the marketplace, internal growth rates will depend foremost on which of the three companies can recognize appropriate opportunities as they arise—and supplement their internal growth with strategic acquisitions.

On a forward enterprise-to- FY ’07 revenue multiple, all three companies are fairly valued: G&K Services, UniFirst, and Cintas sell for 1.0X, 0.98X, and 1.82X, respectively. [Ed. note. Might Cintas’ inviolable premium have something to do with (a) more analysts follow the stock than the other two companies in the aggregate and (b) its (trailing twelve-month) Return-on-Assets and Return-on-Equity of 10.28% and 14.92%, respectively, best its rivals significantly?]

Ironically, many economists consider the demand for uniform rentals & sales to be surprisingly accurate indicators of future economic health. That said, given that the three aforementioned stocks are trading slightly off their 52-week lows—might the stock prices be signaling a slowing job growth market? Therefore, now may not be the time to be a contrarian—at least when it comes to uniform-rental providers.

Investors often overlook SEC filings, and it is the job of the 10Q Detective to dig through businesses’ 8-K and 10-Q SEC filings, looking for financial statement ‘soft spots,'(depreciation policies, warranty reserves, and restructuring charges, etc.)that may materially impact Quality of Earnings.

Wednesday, July 05, 2006

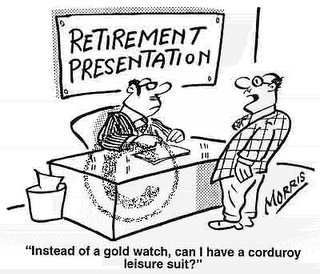

G&K Services: Freezes Pension--What About That Gold Watch?

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment