A number of readers wrote to us after perusing our review on Abraxis Biosciences and queried us with a common concern—if Seattle-based biopharmaceutical company, Cell Therapeutics obtains regulatory approval for XYTOTAX (pronounced “Zi-o-taks”), will this pose direct competition to ABRAXANE?

A clinical and commercial assessment of late-stage cytotoxic agents (like XYTOTAX) for metastatic breast cancer and non-small cell lung cancer (NSCLC), in our opinion, would not prove to be direct competitive threats to ABRAXANE, but, to the contrary, would serve to facilitate physician (and insurance companies) acceptance of alternatives to existing treatment paradigms (and expand the commercial market for targeted therapies like ABRAXANE).

Separately, XYTOTAX would not be a direct competitor to ABRAXANE because the former is seeking its first FDA indication for NSCLC and the latter’s only approved indication (to date) is to treat metastatic breast cancer after a combination of chemotherapy fails or within six months of a relapse.

XYTOTAX is Cell Therapeutics (CTIC-$1.21) chief drug in development.

XYOTAX (paclitaxel poliglumex) is a biologically enhanced chemotherapeutic that links paclitaxel, the active ingredient in Taxol, to a biodegradable polyglutamate polymer, which results in a new chemical entity. When bound to the polymer, the chemotherapy is rendered inactive, potentially sparing normal tissue's exposure to high levels of unbound, active chemotherapy and its associated toxicities. Blood vessels in tumor tissue, unlike blood vessels in normal tissue, are porous to molecules like polyglutamate. Once inside the tumor cell, enzymes metabolize the protein polymer, releasing the paclitaxel chemotherapy.

Initially, the future looked promising for XYTOTAX. However, at the 2006 Annual Meeting of the American Society of Clinical Oncology (ASCO), a composite analysis of phase 3 STELLAR trials of XYOTAX in patients with NSCLC was presented. The outcome data (survival-days) indicated that if XYTOTAX were to reach the market, its patient population would be limited by gender (pre-menopausal female NSCLC patients, since estrogen appears to be the catalyst that makes the drug more effective) and performance status (“PS2”--women who have poor performance status). Unfortunate, for NSCLC patients and the Company, given that more than 50% of the NSCLC population is aged 65 or older.

Nonetheless, the Company is moving forward with the development of XYTOTAX. [Ed. note. In order to justify the generous salaries that the Company pays to its key executives—does the Company have any other alternative?]

After a meeting held with the FDA last month, management announced that the Company and the FDA agreed on a new drug application (NDA) route for XYOTAX for women with lung cancer. The FDA agreed to review an NDA submission based on interim results of the PIONEER trial (designed to test whether single agent XYOTAX provides improved overall survival compared to paclitaxel in chemotherapy-naïve women with NSCLC who are PS2, chemotherapy-naive women with advanced stage NSCLC) with the results of the STELLAR 3 and 4 trials to support the filing. Based on this feedback, if the PIONEER trial meets its pre-specified interim endpoint. The Company plans to submit an NDA in the first half of 2007 and would request a priority (six month) review based on the fast track designation, instead of the standard ten-to-twelve-months.

Nevertheless, our confidence in the agent’s commercial potential is not bolstered after reading that European regulators will allow the biotech drug maker to lower performance endpoints for XYOTAX in order to seek EU marketing approval. The Company said the European Medicines Agency's Scientific Advice Working Party "agreed in principle" that Cell Therapeutics can use a clinical trial where XYOTAX is shown to be not-inferior to other cancer drugs for approval, rather than being superior as originally planned.

Even with FDA approval, Cell Therapeutics may find its “restricted” NSCLC market difficult to penetrate, given tough competition from better-capitalized company’s like Sanofi-Aventis’ TAXOTERE (docetaxel) and Eli Lilly’s GEMZAR (gemcitabine). TAXOTERE is used to treat non-small cell lung carcinoma alone, or like GEMZAR, in combination such as cisplatin.

Additionally, drug-treatment paradigms are difficult to change. For example, despite limitations like adverse-events and poor outcomes, chemo-drugs like cisplatin and vincristine have been used to treat cancer for more than 30 years—and remain at the forefront of treatment. In particular for NSCLC, the last decade has borne witness to expanded drug options, including the introduction of adjuvant and neoadjuvant chemotherapy. Still, suitable therapeutics remain elusive, with five-year survival rates failing to improve—despite advances in drug development.

There are over a dozen NSCLC candidates in late- stage development, with almost half of the pipeline candidates molecular targeted therapies (MTT):

1. Genentech’s TARCEVA (erlotinib) is a small molecule tyrosine kinase inhibitor which works intracellularly to disrupt EGFR function, and has been shown to increase survival in lung cancer patients. The FDA for the second-line treatment of advanced non-small cell lung cancer recently approved TARCEVA.

2. Amgen's novel agent, ABX-EGF (panitumumab), is a human monoclonal antibody directed extracellularly against the epidermal growth factor receptor (EGFr). Phase II data shows outstanding toxicity profiles both for first-and-second line NSCLC. When approved, pricing is thought to be critical to panitumumab’s market success against other MTTs. [Ed. note. EGFR inhibitors show a predictive response best in those cancer patients present with the EGFR mutation—overexpression of EGFR.)

3. Genentech/Roche's AVASTIN (bevacizumab) is an anti-angiogenesis drug that works by blocking the signal protein vascular endothelial growth factor (VEGF) and is gaining prominence as an important tool in the treatment of cancer. The FDA first approved AVASTIN (in combination with intravenous 5-fluorouracil-based chemotherapy) for use in colon cancer in 2004. Early results from a large randomized clinical trial for patients with previously untreated advanced non-squamous, non-small cell lung cancer show that those patients who received AVASTIN in combination with standard chemotherapy lived longer than patients who received the same chemotherapy without AVASTIN.

4. Other MTT in NSCLC mid-to-late-stage development include AstraZeneca's ZACTIMA (vandetanib/ Phase 2 trials); NEXAVAR is the first oral multi-kinase inhibitor that targets both the tumor cell and tumor vasculature, and is currently in the (900) patient enrollment stage of a pivotal Phase 3 trial sponsored by Onyx Pharmaceuticals & AG Bayer designed to compare length of survival in NEXAVAR when co-administered with two chemotherapeutic agents - carboplatin and paclitaxel - versus carboplatin and paclitaxel alone; and, a multi-center phase 2 randomized trial presented at ASCO 2006 has demonstrated that Millennium Pharmaceuticals/Johnson & Johnson's VELCADE (bortezomib), the first in a new class of anticancer agents known as proteasome inhibitors, has significant activity as a single agent or in combination with Taxotere (docetaxel) in patients with non-small cell lung cancer (NSCLC) who have failed at least one prior regimen (toxicity issues are a concern).

Non-small cell lung cancer comprises over 75% of all lung cancers. In 2006, more than 338,000 cases of the disease will be diagnosed. Despite three decades of extensive R&D and chemotherapy use, the overall survival of NSCLC patients still remains below 12 months. The NSCLC death rate now exceeds that of breast, prostate and colon cancers combined.

Given that the unmet needs in NSCLC are so significant, the 10Q Detective argues that treatment paradigms will have to shift—and that multi-modal therapies will gain wider acceptance as first-line treatments. The corollary to our supposition is that there is a built-in market for all proven, next-generation cancer treatment agent—XYOTAX (lower toxicity and potentially increased effectiveness), too.

As best we know, Cell Therapeutics has no direct competitors that focus on the same core competencies (developing a protein based polymer drug like XYOTAX)

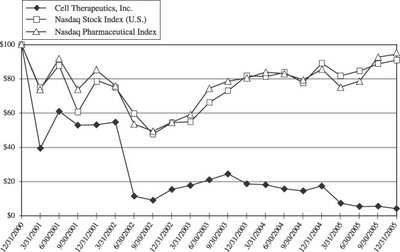

Our readers would also like to know the following: With a market capitalization just shy of $125 million, is the Common Stock of Cell Therapeutics an attractive buy at its current price of $1.21 per share?

Investment Risks and Considerations:

Credibility of Management Team. James A. Bianco, MD, a principal founder, President and CEO, his brother, Louis A. Bianco, Exec. V.P.-Finance & Administration, and the entire executive team have a reputation for being long on hype but short on results. Three years ago, James Bianco confidently predicted that XYOTAX would be on the market by 2005. Chastised [but not humbled], he is now calling for an FDA review—optimistically—in the 1Q:07.

Balance Sheet Weaknesses Limit Financial Flexibility. TRISENOX was, prior to its divestiture to Cephalon in July 2005, the Company’s only commercial product approved by the FDA, EMEA, and the Japanese Ministry of Health to treat patients with relapsed or refractory acute promyelocytic leukemia, or APL. As a result of the divestiture, there were no product sales for the three months ended March 31, 2006.

As of March 31, 2006, Cell Therapeutics had incurred aggregate net losses of approximately $(878.5) million since inception. Corporate expects to continue to incur additional operating losses for at least the next several years. Until XYTOTAX receives FDA marketing clearance, the Company has no material source of recurring revenue.

Without revenue generated from commercial sales, management anticipates that funding to support ongoing research, development and general operations will primarily come from public or private debt or equity financings, collaborations, milestones and licensing opportunities from current or future collaborators.

As of April 2006, the Company had approximately $83.5 million in cash and cash equivalents. However, contractual obligations (convertible notes, interest on notes, operating leases, and long-term debt) totaled $232.6 million.

Additionally, the Company still owes milestone payments [which management may be required to pay pursuant to the amended agreement with PG-TXL Company L.P] of $14.9 million, $5.4 million of which may be triggered in 2007 if XYOTAX is successful with current plans for registrations with the FDA and EMEA.

On June 21, 2006, the Company announced that it had signed a "step-up equity financing agreement" with the French bank, Societe Generale, in which the bank agreed to buy up to $72 million of new common shares of Cell Therapeutics and sell them on the Italian market.

For a Company in such a weakened financial condition, the 10Q Detective questions the dedication of management in shepherding XYOTAX through the FDA approval process. The aforementioned clinical disappointments and regulatory delays have done nothing to temper senior management’s avarice or willingness to enrich themselves at the expense of other shareholders.

James A. Bianco, MD and his brother, Louis Bianco, each earned $1.0 million, $932,647 and $439,030, $426,127 in FY 2005, FY 2004, respectively, in salaries, bonuses, and “other annual compensation.” These payments excluded restricted stock awards of $2.12 million and $1.0 million to each brother, respectively, in FY 2005.

Additionally, in the last three fiscal years—with the Company bleeding red ink—the Board of Directors saw it fit to approve perquisites for Dr. Bianco of $224,628 for travel and entertainment expenses, including the personal use of the corporate jet ((the aircraft was finally disposed of in November 2005—several months after corporate layoffs); and protective services provided for Dr. Bianco and his family as part of the Company’s corporate security program which totaled approximately $216,000, $1,242,201 and $939,537 for 2005, 2004 and 2003, respectively. The corporate security program was cancelled in August 2005.

This should aggravate shareholders, too: The compensation paid to Dr. Bianco during fiscal 2005 that was not performance-based under Section 162(m) exceeded the $1 million dollar limit per officer by approximately $485,000. The Company will not be able to take a federal income tax deduction for this excess amount. [Ed. note. Not that the Company had any profit to worry about!]

As mentioned, in late 2005, the Company sold the corporate plane, eliminated the security program, and gave pink slips to 75 employees. Doing so, the Company is hoping to cut its cash burn rate to approximately $8.0 million per month. In the 1Q:06, the cash burn rate was approximately $8.8 million [Ed. note. Perchance if the Board froze executive salaries, the Company might be able to lower its burn rate to the desired target.]

The Company faces direct and intense competition from better-capitalized competitors in the biotechnology and pharmaceutical industries, and must deal, too, with managed health-care and related-cost containment issues. Aside from the aforementioned therapeutic modalilities with clinically proven outcomes data, Cell Therapeutics will have to negotiate with managed care organizations predisposed to using generic (cheaper) alternatives, including the taxanes—generic paclitaxel (introduced in the U.S. in December 2004) and TAXOTERE (docetaxel), which goes off-patent in 2008.

Pipeline and Portfolio Risks. In addition to XYTOTAX, the Company is also developing pixantrone (pick-san-troan), a novel anthracycline derivative, for the treatment of non-Hodgkin’s lymphoma, or NHL. Preclinical data and clinical studies in more than 175 patients indicate that pixantrone is easy to administer, may exhibit significantly lower potential for cardiac toxicity, and may have more potent anti-tumor activity than marketed anthracyclines (like doxorubicin).

Anthracyclines have been shown to be very active clinically in a number of tumor types. However, they are usually associated with cumulative heart damage that prevents them from being used in a large proportion of patients. Pixantrone has been designed (by altering chemical groups thought to be associated for free radical production) to reduce the potential for these severe cardiotoxicities, as well as to potentially increase activity and simplified administration compared to the currently marketed anthracyclines

Management is targeting an interim analysis from its ongoing phase III study of pixantrone in the 3Q:06, and depending on the results of this analysis, a second interim analysis may be performed in the first half of 2007.

Additionally, Cell Therapeutics is working on CT-2106, a polyglutamate camptothecin conjugate, which is in the phase II component of a phase I/II trial in combination with 5FU/LV for the treatment of colorectal cancer relapsing following FOLFOX therapy and in a phase II trial in ovarian cancer.

Preliminary data of the phase I study of CT-2106 for patients with advanced solid tumor malignancies were presented at ASCO 2006 and successfully showed that the novel conjugate appeared to be well tolerated, with reduced bladder toxicities that characterize the parent camptothecin molecule.

Investor attention is focused on XYTOTAX—and rightly so. Given that the three STELLAR phase III clinical trials for the treatment of NSCLC did not meet their primary endpoint, without a successful PIONEER trial or positive interim results from the PIONEER trial, the 10Q Detective does not expect a favorable regulatory review from the FDA.

We remain concerned, too, with the regulatory strategy presented before the European Union: the aforementioned agreement “in principle" that Cell Therapeutics can use a clinical trial where XYOTAX is shown to be not-inferior to other cancer drugs for approval, rather than being superior as originally planned. At minimum, in our view, such an approach will pose future commercial risk to XYOTAX, for the Company is sacrificing potential sales to secure EU approval. [i.e. Competitors will position XYOTAX as a drug ‘of last resort.’]

Valuation Thesis.

We believe that there is significant risk to owning Cell Therapeutics, and its ability to continue as a going concern is dependent on the ultimate success/failure of XYTOTAX. That said, we have calculated a sum of the parts valuation of Cell Therapeutics’ intrinsic worth (with our expectations calibrated to reflect XYTOTAX’s regulatory approval and risk-adjusted for the potential maximum revenue, costs, time to approval, and probability of approval for the two drugs in the pipeline).

Our sum-of-the-parts valuation assigns an enterprise value of $0.74 per share. Assets include $1.30 for XYTOTAX, $0.47 for pixantrone, and $0.42 for CT-2106—which are offset by a negative cash position of $1.45 per share.

Like we said, the only stakeholders being enriched at Cell Therapeutics are Bianco & Company. They remind us of deer ticks, who will just keep sucking the life blood until they become so engorged, they just fall off their victims—still and all, plump and satiated.

As for shareholders on the outside looking in, look up the oncology term cachexia—for, in our view, that is what is what the future holds in store for shareholders' valuations.

8 comments:

GREAT RESOURCES. YOU DO A WONDERFUL JOB!!!!!!!!!!!!!!!!!!!!!!!!!111

You underestimate the potential of xyotax and pixantrone.

re: Underestimating potential of XYTOTAX & Pixantrone.

I simply used the Company's own "optimistic" run rates of $150 - $200M [by 2016]...multiplied by odds of success, history shows that Phase 2 drugs have a 27% -30% probability of making it thru to FDA approval; and discounted back at a reasonable IRR of 30% to get PV dollar worth for each agent.

speriamo che voli in alto o siamo tutti rovinati.

Thank you for your reply !(underestimating potential of xyotax and pixantrone).

However it seems strange to me such a big difference from your analysis and the one recently published by Zacks.

Have you ever read it ?

Could you please comment on it ?

it's alwyas me (underestimation).

Why you make your calculations with Phase 2 drugs and not Phase 3 drugs : odds of success and IRR are quite different

"Our sum-of-the-parts valuation assigns an enterprise value of $0.74 per share."

September 13th - CTIC 1,84 $

I think I was right saying that you were underestimating the potential of Cell .

Yes, you've done a wonderful job !!

After your critics and your estimation (0,74 $/share) CTIC shares are flying : 1,94 $/share.

Thank you very much.

A CTIC shareholder

Post a Comment