Jim Cramer told viewers of his “Mad Money” television show yesterday that media giant Time Warner (TWX-$16.54) is "so bad that the Company should be called "Time Goner." The stock is not going anywhere unless the company's CEO Richard Parsons starts playing the right game…. The cable business is all about the triple play (cable, telephone and Internet) right now. Parsons needs to realize that his ace is his cable business and that he needs to throw everything else out. This move would make Time Warner jump to $26 a share.”

Jim Cramer told viewers of his “Mad Money” television show yesterday that media giant Time Warner (TWX-$16.54) is "so bad that the Company should be called "Time Goner." The stock is not going anywhere unless the company's CEO Richard Parsons starts playing the right game…. The cable business is all about the triple play (cable, telephone and Internet) right now. Parsons needs to realize that his ace is his cable business and that he needs to throw everything else out. This move would make Time Warner jump to $26 a share.”Cramer has a valid point, for in the last two years, the stock price of TWX has traded in a narrow-band [$16.00 - $19.90]—and in the last year, the stock has lost 5.75% in value (vs. a 52-week change of 6.89% in the S&P 500 Index).

We beg to differ, however, when he said on his recap that, “The Company’s AOL business "is worthless," and Time Warner should sell it immediately….”

Although concerns do exist on whether or not AOL can execute on its recently announced ‘free’ web-portal strategy, the double-play of (1) continued growth in advertising revenue [growth exceeded 30% across all advertising product categories in the 2Q:06] and (2) cost-cutting measures [such as marketing scalebacks] are expected to more than offset subscription revenue losses (and the Company has targeted a goal of $1.0 billion in cash flow savings by the FY end of 2007).

Despite an increase in (dial-up) churn—AOL members declined 976,000 in the 2Q:06—the footprint of this Internet & Content Provider still stands at an impressive 17.7 million members. Monthly ARPU for the total membership base rose to $19.42 in the current quarter.

On August 3, AOL expanded content with the launch of 45 video-on-demand sites (free—but with commercials). In our view, this is part of the new strategy to grow traffic—and advertising revenues.

There may be unrecognized incremental value in AOL’s recent sojourn to mining for precious metals, too. What? Say, you….

Tuesday, AOL announced that it intended to dig up the yard belonging to the grandparents of Davis Wolfgang Hawke—in pursuit of (alleged) buried gold and platinum.

Mr. Hawke disappeared after losing a $12.8 million judgment to AOL in federal court in Virginia under the Can-Spam Act.

Last year, AOL confiscated a Hummer and $100,000 in gold bars and cash from another spammer in Massachusetts.

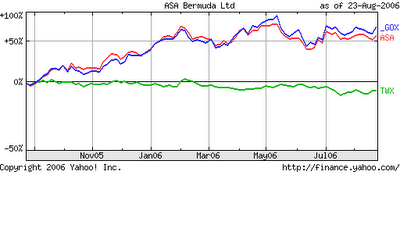

Perhaps if AOL makes this a permanent part of their new business model—going after more spammers’ hard assets—the Common Stock of its parent company might start tracking the trading gains of the CBOE Gold Index (and related gold mining stocks)?

No comments:

Post a Comment