As of June 16, 2006, Vonage Holdings Corp. (VG-$9.60) is the target of 10 class action lawsuits (and still climbing) that claims the Internet phone company beguilingly steered consumers (through its Directed Share Program) toward investing in its $531 million initial public offering. The company had set aside 4.2 million IPO shares for its customers [A daily Class Action Tracker is provided courtesy of Eric Savitz’s Tech Trader Daily.]

Shares of Vonage have plunged 45.6% from the May 24, 2006, IPO of $17.00 per share.

Among assorted violations of federal securities laws, a theme of alleged insider fraud runs through all the complaints. More specifically, the Company (management) failed to disclose and misrepresented the following material adverse facts: (1) Vonage failed to disclose to potential investors in its prospectus that its technology platform experienced problems carrying telephone data over the networks of certain Internet service providers, including Time Warner Inc.'s AOL; (2) that Vonage's broadband Voice over Internet Protocol (VoIP) technology did not properly allow facsimile transmissions; (3) that the Company did not adequately inform investors about the history of Vonage's management team. Specifically, that Vonage failed to disclose that Tyco's ADT Security division took $600 million in charges for accounting improprieties while defendant Michael Snyder was President of the division; (4) that the Company did not adequately inform its retail customers that Vonage customers that participated in the Directed Share Program were obligated to purchase allocated shares before they received notice that their conditional offers had been accepted, and were led to believe that the IPO would take place later than May 23, 2006; and (5) the Company, realizing that institutional investors who normally buy in IPOs would be reluctant at best to purchase Vonage shares as-priced, recommended the purchase of its securities to customers irrespective of their investment suitability.

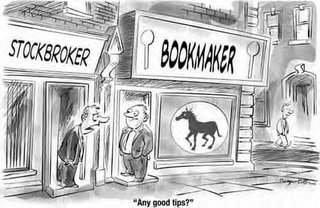

Readers know that the 10Q Detective is sympathetic to investors who have lost monies due to corporate malfeasance. It is our opinion, however, that in the case of Vonage, investors just dialed a wrong number in their search for quick profit.

.

Yes, the Registration Statement (Form S-1) reads like Tolstoy’s War and Peace; nonetheless, the potential loss of an investor’s monies are accented in plain English in the Risk Factors section on Page eight [even if an investor felt lost in reading the fine print—each risk is summarized and spelled out in bold, italic font]:

Vonage has incurred increasing quarterly losses since our inception, and expects to continue to incur losses in the future. For the period from its inception through March 31, 2006, Vonage's accumulated deficit was $467.4 million…. The Company intends to increase its marketing expenses in future quarters in order to replace customers who terminate service, or “churn.” Further, marketing expense is not the only factor that may contribute to net losses. For example, interest expense on convertible notes of at least $12.7 million annually will contribute to net losses. As a result, even if Vonage significantly reduces its marketing expense, the Company may continue to incur net losses.

If Vonage is unable to compete successfully, it could lose market share and revenue. The telecommunications industry is highly competitive. Vonage faces intense competition from traditional telephone companies, wireless companies, cable companies and alternative voice communication providers. Principal competitors are the traditional telephone service providers, namely AT&T, Inc. (formerly SBC Communications Inc.), BellSouth Corp., Citizens Communications Corp., Qwest Communications International Inc. and Verizon Communications, Inc., which provide telephone service based on the public switched telephone network. Some of these traditional providers also have added or are planning to add VoIP services to their existing telephone and broadband offerings.

The Company also faces, or expects to face, competition from cable companies, such as Cablevision Systems Corp., Charter Communications, Inc., Comcast Corporation, Cox Communications, Inc. and Time Warner Cable (a division of Time Warner Inc.), which have added or are planning to add VoIP services to their existing cable television, voice and broadband offerings.

Further, wireless providers, including Cingular Wireless LLC, Sprint Nextel Corporation, T-Mobile USA Inc. and Verizon Wireless, offer services that some customers may prefer over wireline service. In the future, as wireless companies offer more minutes at lower prices, their services may become more attractive to customers as a replacement for wireline service. Some of these providers may be developing a dual mode phone that will be able to use VoIP where broadband access is available and cellular phone service elsewhere, which will pose additional competition to Vonage’s offerings.

Most traditional wireline and wireless telephone service providers and cable companies are substantially larger and better capitalized than Vonage and have the advantage of a large existing customer base….. Any of these [competitive] factors could make it more difficult for Vonage to attract and retain customers, cause Vonage to lower its prices in order to compete and reduce its market share and revenues.

If VoIP technology fails to gain acceptance among mainstream consumers, the Company’s ability to grow its business will be limited. The market for VoIP services has only recently begun to develop and is rapidly evolving. The Company currently generates all of its revenue from the sale of VoIP services and related products to residential and small office or home office customers….If mainstream consumers choose not to adopt Vonage’s technology, its ability to grow business will be limited.

Vonage’s emergency and new E-911 calling services are different from those offered by traditional wireline telephone companies and may expose the Company to significant liability. Delays customers encounter when making emergency services calls and any inability of the answering point to automatically recognize the caller's location or telephone number can have devastating consequences. Customers have attempted, and may in the future attempt, to hold the Company responsible for any loss, damage, personal injury or death suffered as a result. Some traditional phone companies also may be unable to provide the precise location or the caller's telephone number when their customers place emergency calls. However, traditional phone companies are covered by legislation exempting them from liability for failures of emergency calling services and Vonage is not.This liability could be significant. In addition, the Company has lost, and may in the future lose, existing and prospective customers because of the limitations inherent in its emergency calling services. Any of these factors could cause the Company to lose revenues, incur greater expenses or cause Vonage’s reputation or financial results to suffer.

Flaws in the Company’s technology and systems could cause delays or interruptions of service, damage the Company’s reputation, cause the Company to lose customers and limit future growth. Service may be disrupted by problems with Vonage’s technology and systems, such as malfunctions in software or other facilities and overloading of the network. Customers have experienced interruptions in the past and may experience interruptions in the future as a result of these types of problems. Interruptions have in the past and may in the future cause Vonage to lose customers and offer substantial customer credits, which could adversely affect revenue and profitability.

Vonage may not be able to maintain adequate customer care during periods of growth or in connection with the addition of new and complex Vonage-enabled devices, which could adversely affect the ability to grow and cause financial results to be negatively impacted.

If Vonage is unable to improve its process for local number portability provisioning, its growth may be negatively impacted.

The past background of Vonage’s founder, Chairman and Chief Strategist, Jeffrey A. Citron, may adversely affect the Company’s ability to enter into business relationships and may have other adverse effects on business.

The list of additional risk factors related specifically to Vonage, and [in general] to the VoIP industry runs on in the prospectus for fifteen pages. In respect to the aforementioned putative class-action lawsuits, shame on investors, for even if the IPO prospectus allegedly contained misrepresentations or some omissions concerning various Vonage products, the 10Q Detective contends that there was more than enough material information made public for investors to have made their own educated decisions as to the financial appropriateness of buying shares in the Vonage IPO.

Sadly, greed can blind investors to fiduciary prudence. And class actions are promoted by trial lawyers as a ‘no upfront’ cost platform to recoup losses. Press releases tell you how Vonage wronged you and e-mail gives you a convenient way to contact the lawyers. And thereupon, let us not forget the website, where Greed, Greedier & Greediest lets you know that they have substantial experience representing investors who have suffered losses buying stocks like Vonage

Class actions can enable plaintiffs' attorneys to pursue claims on behalf of clients with little interest in the case and extract settlements from defendants whose cases look better on the merits. For example, in one recent case, defendant corporations settled a class action case for approximately $200 million, even though a litigation risk expert assessed the probability of the plaintiffs' case winning at trial at only 7 percent. For companies, it is often cost-prohibitive to litigate the claim, so they settle—which has the unintended effect of encouraging lawyers to file still more such suits.

In 2004, according to a Presidential commission, the costs of litigation per person in the United States was far higher than in any other major industrialized nation in the world. Lawsuit costs have risen substantially over the past several decades, and a significant part of the costs from lawsuits goes to paying lawyers' fees and transaction costs -- not to the injured parties. This explosion in litigation is creating a logjam in America's civil courts and threatening jobs across America. Small businesses spend, on average, about $150,000 per year on litigation expenses.

The 1995 Reform Act, Uniform Standards Act of 1998, and the Class Action Fairness Act of 2005 (hinders so-called judge shopping)—all attempts at ending rampant and frivoulous lawsuits by trial lawyers. Despite Bush’s people calling the latest bill as a victory for tort reform, recent security class-action activity begs the 10Q Detective to reach a contrary opinion: Vonage, The Este Lauder Companies, Inc. (EL-$38.35), Yahoo! (YHOO-$30.36), Jarden Corp. (JEH-$29.61), and Infosonics Corp. (IFO-$15.49)—among the better and lesser known publicly-traded companies that have been hit recently with one (or more) class-action lawsuits.

.

Yes, the Registration Statement (Form S-1) reads like Tolstoy’s War and Peace; nonetheless, the potential loss of an investor’s monies are accented in plain English in the Risk Factors section on Page eight [even if an investor felt lost in reading the fine print—each risk is summarized and spelled out in bold, italic font]:

Vonage has incurred increasing quarterly losses since our inception, and expects to continue to incur losses in the future. For the period from its inception through March 31, 2006, Vonage's accumulated deficit was $467.4 million…. The Company intends to increase its marketing expenses in future quarters in order to replace customers who terminate service, or “churn.” Further, marketing expense is not the only factor that may contribute to net losses. For example, interest expense on convertible notes of at least $12.7 million annually will contribute to net losses. As a result, even if Vonage significantly reduces its marketing expense, the Company may continue to incur net losses.

If Vonage is unable to compete successfully, it could lose market share and revenue. The telecommunications industry is highly competitive. Vonage faces intense competition from traditional telephone companies, wireless companies, cable companies and alternative voice communication providers. Principal competitors are the traditional telephone service providers, namely AT&T, Inc. (formerly SBC Communications Inc.), BellSouth Corp., Citizens Communications Corp., Qwest Communications International Inc. and Verizon Communications, Inc., which provide telephone service based on the public switched telephone network. Some of these traditional providers also have added or are planning to add VoIP services to their existing telephone and broadband offerings.

The Company also faces, or expects to face, competition from cable companies, such as Cablevision Systems Corp., Charter Communications, Inc., Comcast Corporation, Cox Communications, Inc. and Time Warner Cable (a division of Time Warner Inc.), which have added or are planning to add VoIP services to their existing cable television, voice and broadband offerings.

Further, wireless providers, including Cingular Wireless LLC, Sprint Nextel Corporation, T-Mobile USA Inc. and Verizon Wireless, offer services that some customers may prefer over wireline service. In the future, as wireless companies offer more minutes at lower prices, their services may become more attractive to customers as a replacement for wireline service. Some of these providers may be developing a dual mode phone that will be able to use VoIP where broadband access is available and cellular phone service elsewhere, which will pose additional competition to Vonage’s offerings.

Most traditional wireline and wireless telephone service providers and cable companies are substantially larger and better capitalized than Vonage and have the advantage of a large existing customer base….. Any of these [competitive] factors could make it more difficult for Vonage to attract and retain customers, cause Vonage to lower its prices in order to compete and reduce its market share and revenues.

If VoIP technology fails to gain acceptance among mainstream consumers, the Company’s ability to grow its business will be limited. The market for VoIP services has only recently begun to develop and is rapidly evolving. The Company currently generates all of its revenue from the sale of VoIP services and related products to residential and small office or home office customers….If mainstream consumers choose not to adopt Vonage’s technology, its ability to grow business will be limited.

Vonage’s emergency and new E-911 calling services are different from those offered by traditional wireline telephone companies and may expose the Company to significant liability. Delays customers encounter when making emergency services calls and any inability of the answering point to automatically recognize the caller's location or telephone number can have devastating consequences. Customers have attempted, and may in the future attempt, to hold the Company responsible for any loss, damage, personal injury or death suffered as a result. Some traditional phone companies also may be unable to provide the precise location or the caller's telephone number when their customers place emergency calls. However, traditional phone companies are covered by legislation exempting them from liability for failures of emergency calling services and Vonage is not.This liability could be significant. In addition, the Company has lost, and may in the future lose, existing and prospective customers because of the limitations inherent in its emergency calling services. Any of these factors could cause the Company to lose revenues, incur greater expenses or cause Vonage’s reputation or financial results to suffer.

Flaws in the Company’s technology and systems could cause delays or interruptions of service, damage the Company’s reputation, cause the Company to lose customers and limit future growth. Service may be disrupted by problems with Vonage’s technology and systems, such as malfunctions in software or other facilities and overloading of the network. Customers have experienced interruptions in the past and may experience interruptions in the future as a result of these types of problems. Interruptions have in the past and may in the future cause Vonage to lose customers and offer substantial customer credits, which could adversely affect revenue and profitability.

Vonage may not be able to maintain adequate customer care during periods of growth or in connection with the addition of new and complex Vonage-enabled devices, which could adversely affect the ability to grow and cause financial results to be negatively impacted.

If Vonage is unable to improve its process for local number portability provisioning, its growth may be negatively impacted.

The past background of Vonage’s founder, Chairman and Chief Strategist, Jeffrey A. Citron, may adversely affect the Company’s ability to enter into business relationships and may have other adverse effects on business.

The list of additional risk factors related specifically to Vonage, and [in general] to the VoIP industry runs on in the prospectus for fifteen pages. In respect to the aforementioned putative class-action lawsuits, shame on investors, for even if the IPO prospectus allegedly contained misrepresentations or some omissions concerning various Vonage products, the 10Q Detective contends that there was more than enough material information made public for investors to have made their own educated decisions as to the financial appropriateness of buying shares in the Vonage IPO.

Sadly, greed can blind investors to fiduciary prudence. And class actions are promoted by trial lawyers as a ‘no upfront’ cost platform to recoup losses. Press releases tell you how Vonage wronged you and e-mail gives you a convenient way to contact the lawyers. And thereupon, let us not forget the website, where Greed, Greedier & Greediest lets you know that they have substantial experience representing investors who have suffered losses buying stocks like Vonage

Class actions can enable plaintiffs' attorneys to pursue claims on behalf of clients with little interest in the case and extract settlements from defendants whose cases look better on the merits. For example, in one recent case, defendant corporations settled a class action case for approximately $200 million, even though a litigation risk expert assessed the probability of the plaintiffs' case winning at trial at only 7 percent. For companies, it is often cost-prohibitive to litigate the claim, so they settle—which has the unintended effect of encouraging lawyers to file still more such suits.

In 2004, according to a Presidential commission, the costs of litigation per person in the United States was far higher than in any other major industrialized nation in the world. Lawsuit costs have risen substantially over the past several decades, and a significant part of the costs from lawsuits goes to paying lawyers' fees and transaction costs -- not to the injured parties. This explosion in litigation is creating a logjam in America's civil courts and threatening jobs across America. Small businesses spend, on average, about $150,000 per year on litigation expenses.

The 1995 Reform Act, Uniform Standards Act of 1998, and the Class Action Fairness Act of 2005 (hinders so-called judge shopping)—all attempts at ending rampant and frivoulous lawsuits by trial lawyers. Despite Bush’s people calling the latest bill as a victory for tort reform, recent security class-action activity begs the 10Q Detective to reach a contrary opinion: Vonage, The Este Lauder Companies, Inc. (EL-$38.35), Yahoo! (YHOO-$30.36), Jarden Corp. (JEH-$29.61), and Infosonics Corp. (IFO-$15.49)—among the better and lesser known publicly-traded companies that have been hit recently with one (or more) class-action lawsuits.

.

Better we leave it to the legal blogs to debate the finer points of shareholder litigation reform.

.

Suffice to say, when it comes to a “hot” IPO being offered to you—the individual investor—by either the Company [directly] or by your retail broker, stop and ask two questions? If this deal is so hot, why are the institutions passing on it? And, why me?

No comments:

Post a Comment