Light Sweet Crude for February delivery dropped about 3.4%, or $1.76 a barrel, on Thursday, sending the benchmark oil contract on the New York Mercantile Exchange to its weakest close in twenty months at $50.48/bbl, after the U.S. Energy Department reported that crude supplies jumped 6.8 million barrels to 321.5 million barrels for the week ended Jan. 12, the first increase in eight weeks..

Separately, the American Petroleum Institute said crude inventories were at 322.3 million barrels for last week, up 7.6 million.

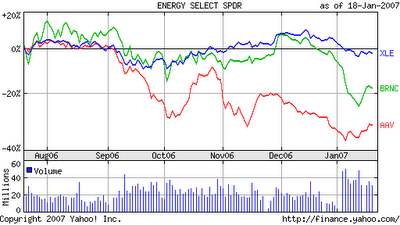

Bloated inventories, recalcitrant OPEC members unwilling to reach an accord on production cuts, and uncertainty created by the Canadian Government’s Tax Fairness Plan—all these factors continue to weigh on North American energy shares.

In our view, oil holding the $50 floor is no longer relevant, for the recent technical weakness in energy shares have opened valuation gaps that have begun to discount lower crude prices energy stocks.

Irrespective of short-term volatility in contract prices, the cornerstone of our investment fundament remains that oil reserve depletion is a given and long term will provide the definitive catalyst to a turnaround in prices, refining margins, and oil drilling/rigging utilization.

The substructure to our argument reflects the political reality, too, that capacity gluts are still vulnerable to disruptions from material suppliers, such as Middle East, Venezuela, Russia, and the Niger Delta.

The promise of ‘maybe’ gains from over-extended tech stocks, or potential false rallies in resource stocks, we prefer to throw our lot in with the latter. Ignoring the bears, 10Q Detective recently added two new opportunistic positions to our resources weighted model-portfolio.

(1). Advantage Energy Income Fund (AAV-$10.90) is a Canadian oil and gas royalty trust based in Calgary, Alberta. Advantage’s oil and gas properties are spread geographically throughout the Western Canadian Sedimentary basin, with 87% of the Fund’s reserves located in Alberta, 5% in northeast Brirish Cxolumbia and 8% in southeast Saskatchewan. Advantage produces the equivalent of 30,000 barrels of oil per day: light or medium-gravity oil and natural gas account for 35%, 33% and 65%,67% of aggregate production and known reserves, respectively.

Responding to the cyclical downturn in energy prices and the uncertainty caused by the recent Canadian government's decision to slap a new Distribution Tax on income trusts, the share price of Advantage has tumbled about 30% in the past quarter.

Typical of the “herd mentality,” from Bay Street to Wall Street, the result was a market over-reaction to the Ministry of Finance’s tax announcement. In our view, given Advantage’s trading metrics, the price looks attractive:

- Given the current uncertainty and the need for future cap expenses, we forecast a downward adjustment of the monthly cash to $U.S. 0.12 per Unit from the recent cash distribution for the month of November of U.S. $0.16 per Unit. Nonetheless, the revised distribution represents an annualized yield of 13.2 percent.

- The Company has a successful history of boosting reserves through (i) aggressive drilling and development of land positions adjacent to operating fields (via land sales, swaps, etc.); (ii) a three-year drilling inventory on 480,000 (net) undeveloped acres; (iii) swapping, selling, or farming out high risk exploration plays; and, (iv) acquisitions to complement and grow long life asset base (see recent Ketch Resources Trust deal). In the last five years, the reserve life index has increased from 7.2 years to approximately 11.3 years.

- Advantage has an active go-forward hedging program in place to protect cash flow. [Summer 2007/ Natural gas & Crude Oil (WTI), $7.18/mcf – $9.26/mcf and $65.00/bbl – $90.00/bbl, respectively.]

- Tangible book value is $8.94 per share. The trailing twelve-month leveraged free-cash flow generated was $52.3 million.

As of September 30, 2006, Advantage has an accumulated deficit of about $(387.1) million, the result of Advantage distributing three times as much in dividend distributions than accumulated income inflows. Lower oil prices and no changes in the Tax Fairness proposal might suggest that our estimated forward dividend payouts are too optimistic [albeit we see a dividend yield of at least 8% - 9% (US$) as a payout floor].

On February 6, Stephen Harper, leader of the Conservative Party was sworn in as the 22nd Prime Minister of Canada. Of investment interest, the Conservatives lead only by coalition, having won only 124 seats in the 308-member House of Commons.

In December 2005, Steven Harper issued the following campaign promise (YouTube) when the Liberal government proposed new taxation on income trusts:

“Income trusts are popular with seniors because they provide regular payments that are used by many to cover the costs of groceries, heating bills and medicine…. The government continues to overtax Canadians and run multi-billion dollar surpluses, yet their first instinct is to attack an Investment vehicle that can make the difference between bare survival and a dignified retirement for millions of Canadians.”

Further, the Conservative federal election platform dated January 13, 2006 stated:

“A Conservative government will…Stop the Liberal attack on retirement savings and preserve income trusts by not imposing any new taxes on them.”

The Conservative government shows no sign yet of changing course, though some coalition lawmakers are having second thoughts.

However, income trusts were given a four-year tax holiday by Ottawa to make the adjustment to the new rules. And a lot can change in four years—especially if one finds their popularity poll numbers falling.

Some politicians stand firm, falling in the process—ask George Bush (no, not the 43rd President of the United States, but his dad, the 41st President).

“I'm the one who won't raise taxes. My opponent now says he'll raise them as a last resort, or a third resort. When a politician talks like that, you know that's one resort he'll be checking into. My opponent won't rule out raising taxes. But I will. The Congress will push me to raise taxes, and I'll say no, and they'll push, and I'll say no, and they'll push again, and I'll say to them, “Read my lips: no new taxes.” – George Bush, Acceptance Speech, 1988 Republican National Convention, New Orleans, LA (play in browser (beta).

For those readers too young to remember, in the 1992 presidential election campaign, Pat Buchanan made extensive use of President Bush’s phrase in his strong challenge to Bush in the Republican primaries. In the election itself, Democratic nominee Bill Clinton running as a moderate, also pointed to the quotation as evidence of Bush's untrustworthiness, which contributed to Bush losing his bid for re-election.Company Symbol Trade Date Quantity Price Cost Advantage Energy Income Fund AAV 01/18/2007 300 $10.93 $3,291.93 Bronco Drilling BRNC 01/16/2007 300 $15.01 $4,515.96

(2). Contract gas driller Bronco Drilling Company (BRNC-$15.00) went public at an intial offer price of $17.00 per share on August 15, 2005. Bronco is a provider of contract land drilling services to oil and natural gas exploration and production companies. Bronco currently operates in Colorado, Oklahoma, Kansas, North Dakota, Texas, and Wyoming, with the majority of the wells drilled for its customers in search of natural gas reserves.

The Company owns a fleet of 64 land drilling rigs, with a deployment utilization rate of about 78 percent. The Company recently expanded the scope and scale of its operations with the acquisition of Eagle Well Services Company, which brings to Bronco accretive assets, including workover and well servicing rigs.

Bronco’s contract drilling revenues for nine-months ended September 30, 2006, skyrocketed to $203.3 million compared with $38.8 million for prior year. The Company generated net income of $43.5 million, or share-net of $1.77, compared with a net loss of $(1.71) million, or $(0.12) per share in 2005.

Average operating rigs in operation for the nine-months of 2006 grew to 43 from 17 for the previous year. The growth in rigs was due to the continued refurbishment and deployment of rigs from the Company's inventory. Revenue days for the year-to-date (2006) increased to 11,024 from 3,251 for the previous period. Utilization for the three quarters of 2006 remained stable at 94 percent.

In our view, Bronco is a well-managed star among small-cap oil-service companies. A market capitalization, a forward (2007) P/E multiple, and a book value per share of $382.0 million, 5.51 times, and $12.94, respectively—all these valuations position investors with a standout growth opportunity in the natural gas sector.

By comparison, key statistics for contract drilling competitors are:

- Nabors Industries (NBR-$29.48), market cap – $8.8 Billion; forward (2007) P/E – 6.7x; book value – $11.85.

- Patterson-UTI Energy (PTEN-$23.51), market cap – $3.74 Billion; forward (2007) P/E – 6.3x; book – $9.37.

- Helmerich & Payne (HP-$24.91), market cap. – $2.58 Billion; forward (2007) P/E – 6.3x; book – $13.30.

The Energy Information Administration (EIA) has estimated that U.S. consumption of natural gas exceeded domestic production by 21% in 2005 and forecasts that U.S. consumption of natural gas will exceed U.S. domestic production by 26% in 2010.

In addition, the National Petroleum Council has stated that average “initial production rates from new wells have been sustained through the use of advanced technology; however, production declines from these initial rates have increased significantly; and recoverable volume from new wells drilled in mature producing basins have declined over time.” The Council predicts that by 2013 about 80% of gas production “will be from wells yet to be drilled.”

The 10Q Detective believes that Bronco—through its strategic acquisitions—is well positioned to be more than just a ‘bit player’ in the contract-drilling sector. Pricing, rig availability, experience of its rig crews, and its offering of ancillary services—in terms of scope and scale, oil and natural gas exploration and production companies looking to increase drilling activity in the U.S., are finding Bronco to be a standout among the best operators.

Accelerating gas field depletion rates and healthy demand for natural gas, in our view, will continue to support activity and demand for land drilling A successful execution of Bronco’s business plan—to expand its rig fleet, geographic focus, and ancillary rigging/hauling services—by an experienced management team should result in higher rig day rates and rig utilization in the coming years.

Disciplined investors should be rewarded with attractive returns.

Editor David J Phillips holds financial interests in Bronco Drilling and several Canadian royalty income trusts, including Advantage Income Fund. The 10Q Detective has a Full Disclosure policy.

I am thinking of investing in this company--or was until I read your incredibly well written article. Are you still thumbs down on this company? The underlying technology seems powerful, they seem to have first mover advantage, and they seem to be building a global sales structure...

ReplyDeleteThey also seem to be small, underfunded and need more sales.

They also seem to be getting nailed by shorties. In any case, still thumbs down?

Thanks. Just stumbled across your blog researching StarTech and have bookmarked it--looks great.