Abatix (ABIX-$6.63) is principally engaged in distributing environmental, safety and construction equipment and supplies to contractors and manufacturing facilities in the western half and southeastern portion of the United States.

International Enviroguard Systems, Inc. (IESI), the Company’s wholly owned subsidiary, imports disposable protective clothing from China, and sells the clothing products through Abatix’s distribution channels.

At September 30, 2006, the Company sold about 30,0000 products to an account base of more than 3,500 customers from eight distribution centers strategically located in six states, including Jacksonville, Florida.

Financial Review

Consolidated net sales for the first nine months of 2006 fell 1.2% to $50.3 million from 2005. Management attributed the decrease in sales to the environmental market due to the lack of headwinds in 2006 comparable to 2005 (about $9.0 million in incremental sales from hurricanes), partially offset by increased sales volume to the construction and industrial markets.

Although no vendor accounted for more than 10 percent of the Company’s sales, three product classes (groupings of similar products) accounted for greater than 10 percent of sales for the first nine months of 2006 or 2005: plastic sheeting and bags, disposable clothing, and abatement and restoration equipment accounted for approximately 20 percent, 13 percent, and 8 percent of net sales in the first nine months of 2006, respectively.

During the nine months ended September 30, 2006 and 2005, no single customer accounted for more than 10 percent of net sales, although sales to Abatix’s top ten customers were approximately 17 percent and 20 percent of consolidated net sales in those periods, respectively. In addition, sales to environmental contractors were approximately 43 percent and 48 percent for the nine months ended September 30, 2006.

As a result of higher SG&A, interest expense, and effective tax rate, operating profit decreased 170 basis points to 3.5% of sales for 2006. Net earnings of $766,000 or share-net of 45 cents, fell about 50 percent compared with 2005.

On September 30, 2006, the Company's balance sheet included net working capital of $9.6 million; less inventories and prepaid expenses, however, and net working capital drops to $(2.1) million

[Ed. note. The Company’s equipment notes are comprised of term notes of 24 to 60 months in length. Certain of these term notes also have a call feature, and are therefore classified as current liabilities on the Consolidated Balance Sheets, which distorts net working capital and the quick acid ratio.]

To our new readers, the importance of reviewing debt ratios—while telling us little about the Company’s growth prospects—are as vital as a stethoscope is to a physician in gauging the [financial] health of the patient.

Abatix is a debt-leveraged company, which means two things of consequence: (i) limiting management’s growth plans through acquisitions/expansions—unless the Company intends to use its common stock as currency; and (ii) day of debt reckoning.

As of September 30, Abatix carried a debt load approximately 1.4 times as great as its $11.05 in total stockholders’ equity. Nonetheless, Abatix’s interest coverage ratio—a metric used to measure the ability of a company to meet its debt obligations—shows that Abatix’s coverage ratio of 3.4 times, is more than adequate to ensure debt holders remain satisfied.

Abatix’s borrowed funds have generated a return in excess of the cost of borrowing, for the trailing twelve-month ROE of 11.84% outpaced its weighted cost of capital of 7.65 percent. Management successfully traded on its equity.

Cash provided by operations during the first nine-months of 2006 of $3,034,000 increased when compared to cash used by operations during 2005 of $456,000, attributable to a decline in accounts receivable and inventories, partially offset by net repayments on notes payable. Reported free cash flow was 2.16 million.

Management believes that improvements made to inventory and purchasing procedures and Abatix’s cost structure should continue to positively impact cash flow from operations in upcoming quarters.

Business Outlook

We expect sales in the 4Q:06 and the 1H:07 to be adversely impacted by slowing demand in the industrial and construction markets (due to a sluggish real estate market), partially offset by restoration work (contractors that handle primarily fire, smoke and water damage).

Despite weather predictions to the contrary, hurricanes in the Gulf Coast region proved to be non-recurring in 2006. Consequently, when expected first-responder sales failed to materialize, momentum investors fled Abatix stock, and the shares fell 51.7% in value (52-week change).

In our view, two growth drivers could provide the Company with the ability to achieve a greater rev run rate than currently expected by apathetic investor: (i) further penetration of the industrial protective clothing market for industry, municipalities, and healthcare combined with first responders on the federal, state and local levels; and (ii) increased visibility in certain sub sectors of the restoration industry—(in addition to asbestos and lead abatement) think mold remediation.

Seeing an opportunity to leverage its current product lines with some additional lines, including consulting and training, the Company entered the Homeland Security market in August 2002.

Much of the Company’s activity in this industry to date has been with the public sector attempting to outfit the first responders. Because these activities are broad in scope and tend to be large dollar orders, the purchasing departments for these governmental entities solicit bids and generally select the lowest product price. Since Abatix’s business model was not cost effective in this environment, management restructured its costs in this market in 2004 and now believes the Company is able to be a cost effective supplier.

The Company is working, too, with the private sector businesses, which traditionally focus on the custom value Abatix provides, and less on the price of the product. As the economy continues to strengthen, companies may invest more dollars in Abatix’s products and services so their facilities and personnel are protected. However, management believes that unless there are regulations mandating security products or another attack similar to September 11th, the private sector may not be willing or will continue to be slow to invest significant dollars.

Any and all growth initiatives will require fresh acquisitions and the construction of strategically located new distribution locations—which will requires fresh working capital.

Valuation Analysis

Competitors in the industrial protective clothing market include Lakeland (LAKE-$14.80) and Alpha Pro Tech (APT-$2.84), selling at trailing twelve-month P/E multiples, Enterprise Value/Revenue and Enterprise Value/EBITDA multiples of 15.01x and 24.01x, 0.86x and2.08x, and, 9.38 and 14.9 times, respectively.

Abatix is priced cheap by comparison, with a trailing twelve-month P/E multiple, Enterprise Value/Revenue and Enterprise Value/EBITDA multiples of 8.59x, 0.26x, and 5.48 times, respectively.

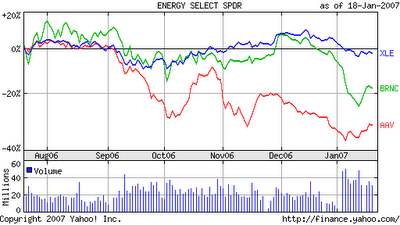

Abatix has displayed an unimpressive technical chart—until now. After hitting $15.00 per share in January 2006, Abatix hit headwinds, trading in a downtrend channel ever since, but the stock has finally landed on solid ground these last three months, consolidating in the $6.00 –to- $7.00 support level—and possibly exhibiting a classic Inverse Head And Shoulders pattern.

In our view, there is no need to rush out to buy Abatix shares. Still we will be watching, looking for signs of a break out—and close—above the $7.00 neckline resistance point (on higher than average volume of 16,542 shares per day).

The catalyst for a sustainable upward move in share price will be renewed investor confidence that Abatix has finally turned the corner, and is seeing greater traction in all business segments.

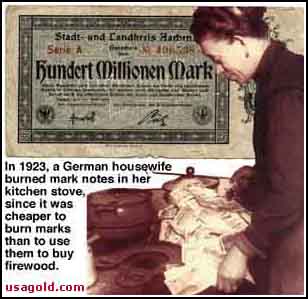

From the King James Version of the Bible, Revelation chapter 6, verse one: “And I saw when the Lamb opened one of the seals, and I heard, as it were the noise of thunder, one of the four beasts saying, Come and see.” [Ed. note. Reference to The Four Horsemen of the Apocalypse: War, Famine, Pestilence, and Death.]

June is six months away, but adverse weather events could be the calculi that produce impressive trading gains in Abatix’s share price: The National Oceanic and Atmospheric Administration (NOAA) has already issued 2007 hurricane advisories, predicting that that there could be between thirteen and sixteen named storms. Of those storms, between 8 and 10 would reach hurricane strength and four to six would go on to become major hurricanes.

Spokesmen at the NOAA have said: “Be informed and be prepared.”

We believe that investors ought to heed similar advice.