Sleepwalking through most of the spring, shares of Comtech Telecommunications (CMTL-$38.71) sprang awoke in June 2006, and have jumped about 50% in value after the telecom-equipment maker raised its guidance outlook (for FY 2006).

Sleepwalking through most of the spring, shares of Comtech Telecommunications (CMTL-$38.71) sprang awoke in June 2006, and have jumped about 50% in value after the telecom-equipment maker raised its guidance outlook (for FY 2006).On Monday, management raised its guidance (again) for 2007 earnings to $2.05 to $2.07 per share, up from its previous view of $1.93 to $1.95 a share.

The Company said that it expects 2007 revenue of $440 million to $450 million, up from its previous outlook of $435 million to $445 million, citing demand for its Movement Tracking System (due to deliveries on actual and anticipated new orders from the U.S. Army and Army National Guard for ongoing support of MTS program activities).

According to Reuters estimates, analysts were expecting 2007 earnings of $1.80 a share, before special items, on revenue of $439.4 million.

Comtech said in its most recent fiscal quarter ended October 31, 2006, its 1Q:07 profit fell 6 percent, hurt by higher operating expenses and lower sales in mobile data communications and RF microwave amplifiers. According to management, the decrease in net sales was due to a decision, made in fiscal 2006, to significantly de-emphasize stand-alone sales of low margin turnkey employee mobility solutions. The Company, however, still beat estimates, posting share-net of 41 cents on revenue of $97.1 million.

Consensus estimates had forecast earnings of $0.32 per share, on revenue of about $90.4 million.

In assessing the quality of its earnings, the 10Q Detective is surprised that investors and analysts alike failed to comment that almost the entire nine-cent positive EPS surprise can be traced back to a doubling of interest income for the quarter ($3.2 million as compared with $1.8 million for three months ended October 31, 2005).

Net cash used in operating activities was $3.6 million for the three months ended October 31, 2006. The loss principally reflected changes in working capital balances, most notably an increase in inventory that management currently anticipates will be delivered to its customers (primarily the U.S. government) throughout fiscal 2007, as well as the timing of payments for accounts payable and certain accrued expenses during the three months ended October 31, 2006.

Nonetheless, the Company’s balance sheet looks healthy: access to $245.6 million in unrestricted cash; $321.3 million in working capital; a total debt/total capitalization ratio of about 28 percent (which includes $119.4 million in total contractual obligations of $119.4 million—almost $105.7 million does not come due until after 2011); and, a tangible book value of $11.13 per share.

Comtech conducts its business through three business segments:

- The Company’s Telecommunication Transmission segment provides sophisticated products and systems (used to enhance bandwidth efficiency) for voice, video and data transmission in satellite, over-the-horizon microwave and wireless line-of-sight telecommunication systems (where terrestrial communications are unavailable, inefficient, or too expensive). This operating unit is currently Comtech’s largest business segment, representing 53.6%, or $50.9 million, in net sales for the most recent quarter (up from 47.7% last year).

- The Mobile Data Communications Services segment (36.7% of 1Q:07 net sales) provides its defense and commercial customers with an integrated solution—including mobile satellite transceivers and satellite network support—to enable satellite-based mobile communications when real-time, secure transmission is necessary.

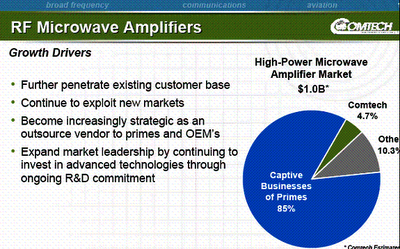

- The RF Microwave Amplifiers segment produces solid state, high-power broadband amplifiers which are incorporated into sophisticated applications, including aircraft air-to-ground satellite communications, medical oncology systems, instrumentation and a variety of defense applications (such as cargo inspection systems for Homeland security). Net sales were $9.4 million for the three months ended October 31, 2006, a decrease of $6.9 million, or 42.3%, compared with the prior year period. The decrease in net sales was due to lower sales (as anticipated) of amplifiers that are incorporated into improvised explosive device jamming systems.

Industry Background

The Global Development of Information-Intensive Economies. Businesses, governments and consumers have become increasingly reliant upon the Internet and multimedia applications to communicate voice, video and data to their customers and employees around the world. Demand for these high-bandwidth applications should continue to grow.

Demand for Increased Communications Cost Efficiencies. Due to the significant increase in global voice, video and data communications traffic, communications service providers have been forced to increase their investments in transmission infrastructure in order to maintain the quality and availability of their services. As a result, communications service providers are continually seeking technology solutions that increase the efficiency of their networks in order to reduce overall network operating costs. In light of the relatively high cost of satellite transmission versus other transmission channels, we agree with Comtech that communications service providers will make their satellite equipment vendor selections based upon the operating efficiency and quality of the products and solutions.

The Emergence of Information-Based, Network-Centric Warfare. Militaries around the world, including the United States military, have become increasingly reliant on information and communications technology to provide critical advantages in battlefield, support and logistics operations. Situational awareness, defined by knowledge of the location and strength of friendly and unfriendly forces during battle, can increase the likelihood of success during a conflict. As evidenced in the recent Iraqi conflict, stretched battle and supply lines have used satellite-based or over-the-horizon (OTH) microwave communications solutions to span distances that normal radio communications, such as terrestrial-based systems, are unable to cover. The need for these technologies should remain high due to the lack of terrestrial-based communications infrastructure in many parts of the world where the U.S. and other militaries operate.

Growth Drivers

The Company’s Telecommunications Transmission segment provides equipment and systems used to transmit voice, video, and data between Point A and Point B, or to multiple points C. The two primary product lines—Satellite Earth Station Products and Over-the-Horizon Microwave Systems—address markets where terrestrial infrastructure is unavailable or inefficient and provide transmission capacity to satisfy increasing bandwidth demand.

In addition to video transmission and cellular backhaul equipment, the Company sees growth for its Satellite Earth Station products and in OTH capacity.

Earlier today, Comtech received an order (for up to $4.3 million) to support the fielding and training of U.S. Army Troposcatter Terminals. Irregularities in the refractive index of air causes Tropospheric scatter, which can cause harmful interference in signal transmission. Troposcatter relay facilities, however, can use this lower atmospheric phenomenon to boost long-distance point-to-point services.

Comtech is well positioned to drive top-line growth by leveraging its existing client base’s need for tropospheric scatter modem upgrades and for next-generation terminals.

Management also sees expanding opportunities for its OTH microwave systems with oil and gas companies and foreign governments.

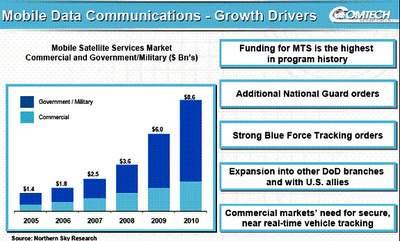

Prospects look just as encouraging for the Company’s Mobile Data Services segment. Spending in both the government and commercial sectors is expected to remain high through the decade.

Albeit the $418.0 million contract with the United States Army for the Movement Tracking System ends in July 2007, supplemental funding is readily available for Comtech’s next generation satellite transceiver, known as the MT 2012, which offers increased speed and performance.

MTS growth is being fueled, too, by Comtech’s successful ability to land contracts with other Department of Defense branches (and U.S. allies?).

In October 2006, Comtech received a $1.6 Million order for the Army National Guard's acquisition of Movement Tracking System equipment. The order is for the supply of installation kits to continue the deployment of MTS equipment throughout the Army National Guard.

Management believes that if current funding levels of MTS and battlefield command and control applications are maintained or increased, or if and when the Company receives additional orders from the Army National Guard, Comtech may experience additional increased operating efficiencies in fiscal 2007.

Valuation Analysis

Assuming share-net growth of (at least) 7.5% per annum, operating margins of about 17 percent, an equity risk premium of 3.0%, and a WACC of 8.3%, the intrinsic value of Comtech is about $53.00 per share.

[Ed. note. The Company is creating value for its shareholders, for ROA exceeds WACC by 200 basis points.]

Comtech offers compelling growth prospects and operates in fundamentally healthy industries, but it is selling for about 19 times forward fiscal ’07 earnings of $2.05 per share (median point of communications equipment companies). Further multiple expansions assume management can execute on all cylinders—and continue to exceed guidance.

The 10Q Detective speculates, too, that Comtech might make an attractive take-out candidate for companies looking to diversify. Call us crazy—why not a buyout by General Motors? Know any other rusty giant looking to buy its way out of a moribund industry?

CEO Fred Kornberg, 71, has been with the Company for almost 35 years. Mr. Kornberg’s existing employment agreement stipulates that if a Change in Control occurs, he is entitled to resign (at will) and would receive a lump sum of approximately $11.7 million (excluding the value of his pension(s) and 622,124 shares of common stock that he beneficially owned as of October 6, 2006).

Insider selling has been limited to share options exercised in the $3.30 - $12.00 per share range.

Investment Risks & Considerations

- A substantial portion of sales is recognized using the percentage-of-completion method. The reason for this is that many new orders—such as Over-the-Horizon microwave systems and mobile satellite systems—are large, multi-year contracts. Ergo, operating results may prove difficult to forecast—increasing stock price volatility.

- In recent years, Comtech has increased its dependence on U.S. government business. Sales to the U.S. government (including sales to prime contractors to the U.S. government) accounted for approximately 47.3%, 42.1% and 40.1% of consolidated net sales for the fiscal years ended July 31, 2006, 2005 and 2004, respectively. Approximately 60.4% of its backlog at July 31, 2006 consisted of orders from the U.S. government.

Sales to the U.S. government represented 56.3% of aggregate sales for the three-months ended September 30, 2006. The Company has significant commercial opportunities for many of its products—such as the oil and gas industry. In order to lessen its dependence on the U.S. government (and leverage growth opportunities in other markets such as commercial satellite-based mobile data applications), management must seek out and secure new distribution channels.

- Comtech’s fiscal 2004 Federal income tax return is being audited by the Internal Revenue Service, other returns may be selected for audit and a resulting tax assessment or settlement could have a material adverse impact on results of operations and financial position (in addition to restating prior year filings).

- Management also said on Monday that its independent accounting firm, KPMG International, told the company on Nov. 30 that one of its staff accountants purchased some of Comtech's common stock. In a Securities and Exchange Commission filing, the company said KPMG is assessing whether its independence has been impaired.

The company said it would file an amended quarterly report as soon as possible with the SEC. If KPMG is found not to be independent, Comtech said it would incur significant additional costs associated with changing independent accountants. [Ed. note. Translation = lowered earnings guidance.]

Editor David J. Phillips holds no financial interest in any of the stocks mentioned in this article. The 10Q Detective has a full disclosure policy.

No comments:

Post a Comment