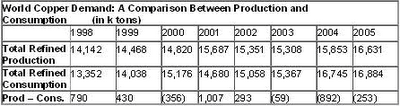

On August 30, 2006, the International Copper Study Group (ICSG) said that its preliminary data showed that world copper production exceeded consumption by 13,000 tons in the first five months of 2006.

Strikes at mines in South America, short covering, and competitive purchases by commodity investment funds—this was the witches brew that resulted in the price of copper hitting a cyclical high in May 2006, when it reached $4.00 a pound.

Longer-term, as articulated by Standard & Poor: “ we are positive on the secular demand for copper…. industrialization of China and India will lead to greater demand. At the same time, the production of copper will increase less rapidly than demand, as output at (some) existing mines is exhausted and fewer mines come into production…. the next market peak should result in copper prices reaching a higher average (price) than the average price seen in 2006 (average price of $2.86 per pound).”

The Alumbrera Mine has an estimated mine life of ten years (to 2016).

Second Quarter 2006 Financial Highlights

For the quarter ending June 30, 2006, Northern Orion recorded record net earnings of $32.8 million, or share-net of $0.18, as compared with net earnings of $3.6 million, or $0.02 per share, for the prior year. Last 12-months earnings were $0.49 per share compared with a share-net loss of one cent a year ago.

The average realized copper and gold prices were $4.44 per pound, or 179% higher, and $608 per ounce, or 44% higher, respectively, than for the same period in 2005.

Northern Orion carries no long-term debt, and at June 30, 2006, the Company had a cash position of $172.4 million (including temporary investments).

Valuation Analysis

Northern Orion has a major catalyst that could unlock potential wealth for the Company and shareholders alike. In late 2004, the Company commissioned an initial feasibility study to support financing of an independent mine and processing facility at its 100% owned Agua Rica Project, a copper/gold development property (also located in the Catmarca Province, Argentina). The property is comprised of mining claims and exploration licenses.

The feasibility study, which is nearing completion, has focused on the cost-economics of commencing planned production approximately three years after the Company obtains all necessary permits.

[Ed. note. According to information supplied by the Company, none of the experts preparing the report had or received any registered or beneficial interests, direct or indirect, in Northern Orion or other property of the Company.]

Guidance does suggest that Agua Rica will be a very low cost producer, based on work completed to date. Subject to confirmation on completion of the updated study, Agua Rica has:

· 23-year life of mine

· Capital costs of $1.9 billion

· Cash costs of $0.09 per pound of copper of net by-products (based on $435/0z gold).

· Drillings indicate that the site may contain 21.8 billion pounds of copper and 13.3 million ounces of gold.

Based on current commodity prices, market conditions, and planned production levels at Alumbrera, the Company expects to receive significant cash flows from Alumbrera for at least the next eight to ten years (trailing-twelve month cash flow was $42.8 million). . Management believes that expected cash flows, along with the Company’s current cash balances, will provide a significant part of the equity contribution necessary to bring Agua Rica into production. Outside financing will be needed, too.

After hitting a 52-week high of $6.32 per share in May 2006, the Common Stock price of Northern Orion has dropped 43 percent, tracing the decline in copper prices.

Copper producer Phelps Dodge (PD-$82.76), with a market capitalization of $17.01 billion, dwarfs the value of Northern Orion (with a market capitalization of $549.1 million)! Of interest to us, however, is that the ROA and ROE of both companies are similar: 15.6% and 24.6% (PD) and 15.9% and 23.1% (NTO), respectively.

Looking at a worst case scenario for 2007—a moderation in residential construction, little labor unrest at mines, and less-than expected consumption in China—doom & gloom consensus estimates are projecting copper prices at $2.40 –to- $2.50 per pound. Readers should remember that even at that price, Northern Orion’s mining costs are significantly lower than this forecast.

In our view, Northern Orion, selling for eight times forward 2007 earnings estimates of $0.45 per share, already discounts an expected further drop in the commodity price of copper to the $2.50 level. A reversal in the price(s) of copper/gold could quickly lead to a turnaround in the share price of Northern Orion, too.

A reasonable P/E multiple for the larger capitalized copper/gold producers is 10 times forward 12-months earnings. Applying this P/E multiple, would imply a $4.50 price per share for Northern Orion. We remind our readers, however, that this price target assumes a lower price for copper and no news on the Agua Rica project. In our view, this company—albeit speculative—offers a compelling growth story. Those patient investors with an eye to long-term fundamentals could be handsomely rewarded.

Investment Risks and Considerations

Weakness in Copper Demand greater than consensus forecasts. A bigger than anticipated drop in the price of copper could adversely impact the financial results of the Company.

Mining operations generally involve a high degree of risks and hazards, including—but not limited to—unexpected seismic activity, cave-ins, flooding, and other conditions involved in the drilling and removal of metals. Although adequate precautions are taken to minimize risk, damage to life, property, and the environment are still a possibility.

Additionally, as Northern Orion is highly dependent on the Alumbrera Mine for current and future revenues, any unforeseen interruption to existing mining activities could have an adverse material impact on the financial performance of the Company.

The development and exploration of the Agua Rica project will require substantial additional financing. Failure to obtain additional capital or other types of financing may result in delaying or a postponement of the development or production of the property. Low gold prices during the five years prior to 2002 adversely affected the Company’s ability to obtain financing, and low gold and copper prices could have similar effects in the future.

How did you find the 10Q/Ks on NTO? EDGAR only has through 2003. How come they are exempt from filing with SEC?

ReplyDeleteGo to NTO's home page:

ReplyDeletehttp://www.northernorion.com/s/home.asp

& click on FINANCIAL INFO tag for quarterly & annual filings.

Thanks. Still would like to know why they are allowed to not file with SEC? I understand they are traded on AMEX.

ReplyDeleteWhat do you think of their option practice? With all cashflow going to capex for the forseeable future, will shareholder value be significantly diluted before any real benefit accrue to the shareholders?

Thanks for your work. I really enjoy following your research. But you do seem to be a bit soft on foreign companies. I would be more cautious about relying on Chinese company financial reports for research, esp. the small caps.

I started looking into the value of Northern Orion because of it dropping in price.

ReplyDeleteI just think it has the potential for huge returns.

The Agua reserves are simply enormous.

What is definitely not in the report is the still births created by the pollution that Agua Rica produces. The contaminated water that is causing animals to die and crops to stop growing. Bajo La Lumbrera is a disaster. Northen Orion claims to have invested over 16 million in exploration in Argentina when the number is far from it. They are milking the public and over billing, Argentine costs are far less than they report. They are a rogue company and will be out of South America very soon. But surely you will not print this, do not worry, it will be publiished in other places nevertheless.

ReplyDelete