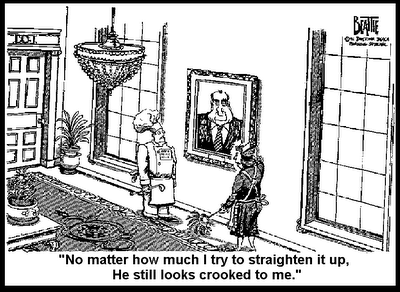

"Far from trying to hide the facts, my effort throughout has been to discover the facts—and to lay those facts before the appropriate law enforcement authorities so that justice could be done and the guilty dealt with." Richard Milhous Nixon, the 37th President of the United States (1969 – 1974), quoted prior to his resignation in the face of imminent impeachment related to the Watergate first break-in and the subsequent Watergate scandal....

Last month, the U.S. Commodity Futures Trading Commission (CFTC) called into question the reputation of the proprietary trading business of the London-based energy giant, BP plc (BP-$71.37). On June 28, 2006, the CFTC filed a Civil Complaint in a Chicago federal court against BP Products North America, Inc., a wholly owned subsidiary of BP. The CFTC alleged that BP traders “with the knowledge, advice, and consent of senior management,” among other things, manipulated the price of February 2004 TET physical propane by illegally cornering up to an estimated 88% of the U.S. propane market by late February 2004. [Ed note. Entering February, BP owned nearly 50% of available physical propane at the TET location.]

The company made $2.97 billion in profit last year from its trading operations, about 13 percent of its 2005 net income of $22.34 billion.

Sold compressed in cylinders of various sizes, propane is a popular fuel used primarily to heat rural homes and businesses. During the winter months, much of the demand for propane is concentrated in the Northeast and the Great Lakes regions of the upper Midwest, in rural areas absent natural-gas distribution networks. This market is served by the Texas Eastern Products Pipeline Co., a pipeline and storage network that runs from Mont Belvieu, Texas, through Ohio and into New York, Pennsylvania and Illinois. Traders call propane running along this line "TET propane."

BP is the leading supplier of natural gas liquids, including propane, in the USA, generating $5 billion in annual sales, according to the company.

Internal BP documents obtained by the CFTC show that a team of BP Houston-based traders sought to establish a long February propane position, withhold a portion of that propane from the market, and artificially drive up the price of propane.

BP’s scheme to corner the market allegedly caused the price of TET propane to become artificially high. By cornering the market, the clandestine trading operation was able to dictate prices to short-sellers seeking to cover their open positions. The CFTC asserts that on or about February 27, 2004, BP’s actions had successfully pushed up the price of propane (briefly) to 94 cents a gallon— a fifty percent price hike that would not otherwise have been reached under the normal pressures of supply and demand.

The CFTC complaint further alleges that by cornering the TET propane market, BP employees sought to generate a profit for BP of at least $20 million “with potential for upside from there.”

Internal BP reports show that the traders calculated odds of a loss from the strategy at 20% and put the potential return anywhere from a $5 million loss to a $15 million gain, the internal report shows.

Ironically, BP lost money when rising prices and trading volumes exceeded smaller trading partners' credit limits, leaving the company with large, expensive stockpiles that plummeted in value at month's end, when that month's futures contracts expired.

Adding to BP's disappointment, the CFTC says, another unidentified propane trader unexpectedly dumped large supplies on the market at month's end, enabling it to collect BP's anticipated profits.

Court documents also reveal recordings of phone conversations between BP traders that show their intent while planning and carrying out the alleged scheme. On phone conversations in early February, for example, Dennis Abbott, one of the Houston-based traders, and Mark Radley, trading manager of BP's natural gas liquids business, discussed their getting others in management to approve of the plan.

Of course, BP denies that it ever rigged propane prices or engaged in illegal trading schemes.

"Market manipulation did not occur," BP spokesman Ronnie Chappell said. "We are prepared to make and prove that case in the courts ... In this situation we investigated the trades in question and cooperated fully with the CFTC investigation. We will assist the Department of Justice in its ongoing investigation," he added.

[Ed. note. Based on its own internal findings, BP published a confidential manual for its traders on how BP could profit in the future from the February 2004 propane debacle, fittingly called, NGL Trade Lessons Learned.]

BP's own investigation resulted in the dismissal of three employees [Abbott, too] for “failure to follow its trading policies,” but the company declined to provide details, saying only that they have since taken steps to strengthen supervision of their trading activities.

Do any of our readers buy into Ronnie Chappell’s transparent insincerity?

Court documents show that BP has been about as cooperative as (“I am not a crook”) President Richard M. Nixon during the Watergate hearings.

As far as Chappell’s veracity—about as believable as Nixon’s secretary, , Rose Mary Woods, when asked why there was a crucial, 18½ minute gap on one of the subpoenaed tapes given in evidence to Watergate investigators, saying “she had accidentally erased the tape by pushing the wrong foot pedal on her tape player while answering the phone.”

The 10Q Detective, traditionally the chronicler of the brackish behavior and pecuniary offenses sired in the boardrooms of Corporate America, thought that our readers (who are paying $3.00 a gallon for gasoline at the pump) might find some glee in this tale of greed gone amiss on the Houston trading floor of energy giant BP (ironically, the home of Enron).

[Ed. note. Speaking of Enron--We caught the following headline on the death of the Enron founder: "Kenneth Lay Dead at age 64." The verb lie means to be in a horizontal position; whereas, the verb lay means to put (something) in esp. a flat or horizontal position. Ergo, when Kenneth died, the proper headline should have read: "Kenneth Lies Dead at Age 64!"]

Post-script:

Abbott, 34, admitted his participation in the manipulation scheme, and on June 29, 2006, entered his guilty plea to a previously filed conspiracy charge in U.S. District Court for the District of Columbia. Under the terms of a plea agreement, Abbott could face up to five years in prison, a fine of $250,000, and supervised release following any incarceration. Additionally, Abbott has agreed to cooperate with law enforcement officials in the ongoing civil investigation against BP.

No comments:

Post a Comment