Bed Bath & Beyond (BBBY-$35.22) has filed its Definitive Proxy Statement, announcing to shareholders that its annual meeting will be held on June 29, 2006. Among the items of business are three proposals submitted by shareholders that will require a vote of consideration:

- ·Whereas, Bed, Bath & Beyond Inc. currently has a Board of 10 people, all of whom are white, and two of whom are female, the Board should publicly commit itself to a policy of inclusiveness and take every reasonable step to ensure that women and persons from minority racial groups are in the pool from which Board nominees are chosen.

- ·Whereas, Bed Bath & Beyond Inc. currently has overseas operations, be it resolved that the shareholders request that the Company commit itself to the implementation of a code of conduct based on the International Labor Organization’s human rights standards and the United Nations’ Norms on the Responsibilities of Transnational Corporations with Regard to Human Rights, by its international suppliers and in its own international production facilities, and commit to a program of outside, independent monitoring of compliance with these standards.

- ·Whereas, rising energy costs and concerns about energy security, climate change and the burning of fossil fuels are focusing increasing amounts of attention on energy efficiency, be it resolved that shareholders request that the Company assess its response to rising regulatory, competitive, and public pressure to increase energy efficiency and report to shareholders (at reasonable cost and omitting proprietary information) by December 31, 2006.

A “FOR” vote by a majority of the votes cast is required to approve these three proposals.

Lester R. Bittel, an internationally recognized authority on management and supervision, said: “Good plans shape good decisions. That's why good planning helps to make elusive dreams come true.”

For these shareholders, despite their fervent hopes, successful passage of the three aforementioned proposals will remain elusive, for there are more timely matters of corporate concern to be debated at the annual meeting. [re: Call for greater Board diversity—Similar proposals were placed before the Annual Meetings in 1999, 2000 and 2001. Support ranged from approximately 10% to less than 25% during that period; re: vendors’ human rights practices—This proposal was presented to shareholders last year. Approximately two-thirds of the shares voted opposed the measure, and it received the support of approximately 18% of the votes.]

In our opinion, these shareholder proposals waste valuable meeting time and distract shareholder attention from questionable corporate activity requiring of answers:

- ·Warren Eisenberg, 75, is a Co-Founder of the Company and has served as Co-Chairman since 1999. Leonard Feinstein, 69, is the other Co-Founder of the Company and has served as Co-Chairman since 1999, too. Each Co-Chairman earned a salary –sorry, “earned” is a poor choice of words—the Company doled out to EACH Co-Chairman $1.10 million in annual salary and $2.40 million in Restricted Stock Units in FY 2005. Additionally, the Company provided $70,703 and $58,051 in FY 2004 to Messrs. Eisenberg and Feinstein, respectively, for personal benefits (such as the use of Company cars for non-business purposes, tax preparation services and other advisory services). As the Board of Directors only met seven times in FY ’05, why does Bed Bath & Beyond need two Chairmen? Granted, for vain posturing, each Co-founder still wants to still think that they are irreplaceable in the hierarchy of the decision-tree at the Company. But must the Company pay them each more than $3.0 million per annum to placate their egos?

· The employment agreements with Messrs. Eisenberg and Feinstein for “executive employment” expire on June 30, 2007, but can be extended by mutual agreement. Under these agreements Messrs. Eisenberg and Feinstein may at any time elect “senior status” (i.e. to be continued to be employed to provide non-line executive consultative services) at a generous 50% of their salary prior to such election…. Blah! Blah! Blah! While on senior status, both men do not have to devote more than 50 hours in any three-month period to his consultative duties. [Postscript. This is a ten-year deal!] Additionally, following the Senior Status Period, Messrs. Eisenberg and Feinstein are each entitled to supplemental pension payments of $200,000 per year (plus a cost of living adjustment) until the death of the survivor of him AND his current spouse. - ·Under the agreements, if Messrs. Eisenberg and Feinstein decide to retire prior to election of their Senior Status Period, the Company must pay them them $700,000 (+) per annum for ten years (or, if the Company chooses, in a lump sum on a present value discounted basis of $7.0 M plus).

Nonetheless [aside from questionable compensation packages to the Co-founders], going into the annual meeting—aside from a depressed share price—Common Stock holders should laud the efforts of management in guiding the Company to a strong 4Q:05 performance (notwithstanding a softening retail spending environment).

For the three months ended February 25, 2006, the Company's consolidated net sales increased by 14.8% to $1.69 billion, as compared to the corresponding quarter last year. Operating margins were in line with consensus estimates of 18.1%, and net earnings increased by $16.9 million, or 9.4%, with an EPS increase of 13.5% to $0.67 per share. (Had management not gone with early adoption of the new stock option expense accounting rules—and not made related compensation plan changes, EPS for the 4Q would have been approximately $0.70 per share, up about 18.6 percent.)

The balance sheet remains healthy. BBBY has been debt-free for a decade, and even after deducting cash used for store openings and improvement programs, ongoing infrastructure enhancements and a $600 million share repurchase program (representing 16.4MM shares and an average price of approximately $36.58), cash equivalents and investment securities totaled about $1 billion at FY ending February 25, 2006. Additionally, net cash provided by operating activities in fiscal 2005 was $660.4 million and free cash flow was $440.1 million.

As of February 25, 2006, the Company operated 809 Bed Bath & Beyond stores; 29 Christmas Tree Shops, and 38 Harmon stores. Square footage totaled approximately 25.5 million square feet at the end of fiscal 2005. During fiscal 2005, the Company opened 83 BBB stores, three CTS stores and four Harmon stores, and closed one BBB store and one Harmon store, which resulted in the aggregate addition of approximately 2.6 million square feet of store space.

On its 4Q:05 Earnings Conference Call, management was comfortable—based on its most recent real-estate analysis—in updating the store openings [square footage] that will fuel this growth: “We now anticipate that we can grow to approximately 1,300 Bed Bath & Beyond stores in the United States [ed. note. before saturation becomes a concern], in addition to continuing the expansion and integration of our Christmas Tree and Harmon store concepts…. expanded information technology capabilities, new merchandising initiatives and developing concepts significantly adds to our potential to create a much larger, more successful retailing business.”

Corporate has issued guidance calling for FY 2006 EPS to grow by approximately 13% to about $2.17 per share, based on the following planning assumptions:

1. The Company’s fiscal 2006 store opening program is expected to include approximately 80 BBB stores, six CTS stores and the continuing development of its Harmon concept. The Company’s new store openings are expected to add approximately 2.5 million square feet of store space.

2. Bed Bath & Beyond new stores are expected to generate net sales of between $160-185 per square foot in the first 12 months of operation. Consolidated comp sales are expected to increase from 3-5% and net sales, including the 53rd week, are expected to increase between 13% and 14%.

3. Based on the current interest rate environment, interest income is expected to be somewhat higher than in FY ’05.

4. The effective income tax rate for FY 2006 is presently being estimated at about 36.6 percent.

5. Average diluted shares outstanding for full FY ’06 is estimated to be 288 million.

6. FY ’06 will be a 53-week year.

The Company has deployed a total of $950 million for share repurchases since December 2004. In our opinion, this demonstrates the impressive cash generating ability of the Company. Aside from initiating a cash dividend payout, the trailing twelve-month ROE of 25.65% suggests that management believes that share buybacks are a prudent investment—and will probably continue as a practical course of action in coming months.

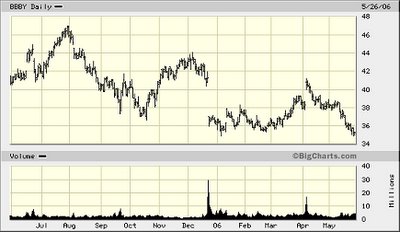

In our opinion, now may be a good time to start accumulating shares in Bed Bath & Beyond. The stock price has already discounted any potential retail slowdown, with the forward P/E of 14 times 2007 consensus estimates of $2.49 is near the stock’s historic trough. Any sales or EPS guidance nudged upward by management will serve as the necessary catalyst to expand the P/E multiple and push the stock to a target value of $45.00 per share.

No comments:

Post a Comment