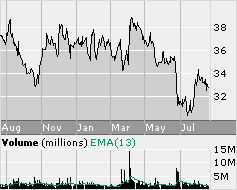

In the last two weeks, shares of Bristol-Myers Squibb (BMT-$20.24) have plummeted 22% on investor concerns that the introduction of generic competition to its blockbuster growth-driver, PLAVIX, would jeopardize the drug-makers’ earnings and dividend.

In the last two weeks, shares of Bristol-Myers Squibb (BMT-$20.24) have plummeted 22% on investor concerns that the introduction of generic competition to its blockbuster growth-driver, PLAVIX, would jeopardize the drug-makers’ earnings and dividend.

On August 8, 2006, after a patent dispute resolution failed to receive required antitrust clearance from New York state attorneys general, Canadian drug maker Apotex launched a generic copy of the blood-thinning treatment, clopidogrel (PLAVIX), even though it's being sued for patent infringement by Bristol-Myers, which holds the U.S. marketing rights to the Sanofi-Aventis (SNY-$43.17) drug.

Bristol’s original patent suit claimed that Apotex infringed on a second patent (US. 4,847,265) covering a chiral compound, that purports to show that the “pharmacologically superior and less toxic” (+) enantiomer of clopidogrel is necessary for the efficacy/safety profile of PLAVIX [and this patent does not expire until 2011].

In February 2002, Apotex filed an Abbreviated New Drug Application (ANDA) with the FDA challenging two of Sanofi’s US patents relating to PLAVIX. Specifically, the company asserted that the original patent [covering both (+)/(-) anantiomers] of clopidogrel, which expired in July 2003, contained the active ingredient sufficient to proceed with the manufacturing of the non-brand name drug. In other words, Apotex argued that the 2011 patent offers no new information and is invalid because the active molecule of PLAVIX is already described in the expired patent. [Generic manufacturers need only show in vivo bioequivalence –no comparative efficacy/outcomes data is needed to bring before the FDA to receive marketing approval.]

Bristol-Myers is going to court this week seeking an injunction to enjoin Apotex Corp. from selling its generic version of the platelet aggregation inhibitor. .

Citing prior settlement concessions, including the recently file document with the SEC that Bristol-Myers had waived its right to seek treble damages [had Apotex gone ahead with its intended launch while litigation was ongoing], analysts think that the drug-maker has less than a 50% chance of being granted the desired temporary restraining order. [Ed. note. Legal experts opine that by reducing the potential penalty “to 40% to 50% of Apotex's net sales,” Bristol-Myers management ‘lowered the bar’ and did not believe that Apotex’s actions posed any material threat to the brand-name franchise!]

Time is money for generic manufacturers. The US FDA offers a 180 day exclusivity period to generic drug makers in specific cases. During this period only one (or sometimes a few) generic manufacturers can produce the generic version of a drug. The bulk of a generic company's profit on a product comes during the 180-day exclusivity period because the lack of competition means it doesn't have to slash prices deeply. Often, they only price at a 25 percent discount to the brand. That discount can fall to 80 percent –to- 90 percent once numerous competitors enter a market.

Prior to the collapse of the trade agreement with Apotex, Bristol management had been in negotiations for a similar settlement with the Indian generic drug firm Dr. Reddy's Laboratories (RDY-$31.00), which has been challenging the PLAVIX patent since April 2002. If Bristol-Myers loses its day in court this week, in 180 days—or sooner—Dr. Reddy’s hopes of selling a cheaper copy of PLAVIX in the United States may bear fruition.

Teva Pharmaceutical Industries (TEVA-$34.51), Watson Pharmaceuticals ($24.28), and Cobalt Pharmaceuticals have filed ANDAs to market copycat versions, too.

In the second quarter ended June 30, 2006, primarily due to increased demand, sales of PLAVIX increased 18% (over the prior year) to $1.14 billion, and contributed 29.3% to total worldwide pharmaceutical sales of $3.9 billion. In FY ’05, PLAVIX accounted for $3.8 billion of Bristol's sales, or 20% of the total. .

Ranked by net sales, PLAVIX is currently the largest product sold by Bristol-Myers. In 2005, with $5.9 billion in worldwide sales, PLAVIX was the second-best selling drug after Pfizer Inc.'s (PFE- $25.82) cholesterol lowering drug, LIPITOR.

Generic drugs—because their average wholesale costs are only a fraction of their name brand counterparts—offer higher-margins and are more profitable all the way up the food chain, from pharmacy benefit managers Caremark RX (CMX-$55.91), to health insurer titan UnitedHealth Group (UNH-$47.57), to the nation’s largest drugstore chain CVS Corp. (CVS-$33.90), and to the largest for-profit hospital operator HCA Inc ($48.90).

Even if Bristol-Myers is successful in getting a temporary restraining order, Apotex has brought the drug giant maker to its knees. In a research note, Morgan Stanley's Jami Rubin, said “channel checks suggest some wholesalers and pharmaceuticals benefit managers have up to 6 months worth of generic PLAVIX in their channels.”

Last Wednesday, Medco (the largest U.S. pharmacy benefits manager by revenue), which serves some 65 million members, said it would start shipping the blood thinner to patients who fill the prescription through its mail- order services. According to a company spokeswoman, “Medco members accounted for 24% of PLAVIX's U.S. market share, and more than half of Medco's PLAVIX prescriptions are filled through the company's mail-order pharmacies.”

.

A quick check of online pharmacies by the 10Q Detective found that pharmacists had received initial supplies. The generic drug retails at an average of $51 for sixty – 75mg. Pills, or $0.85 per pill, compared with an average $203 for 56 tablets of PLAVIX made by Bristol-Myers.

Standard & Poor's Ratings Services placed Bristol-Myers’s ‘A+' long-term corporate credit and 'A-1' short-term rating, on CreditWatch (with negative implications), citing the material importance of PLAVIX revenue to the drug manufacturer’s financial health.

PLAVIX contributed approximately $0.40, or 28%, to share-net of $1.43 in FY 2005.

Management is still piloting the drug-maker through the troubled wake of substantial revenue losses (in the last few years) due to the expiration of market exclusivity protection for certain of its products. For 2006, the company estimates reductions of net sales in the range of $1.4 billion to $1.5 billion [excluding PLAVIX] from the 2005 levels for products that have lost or will lose exclusivity protection in 2004, 2005 or 2006, primarily:

PRAVACHOL (patent expired in April 2006), the cholesterol drug, whose patent expired in April 2006, witnesses a year-to-year sales decline of 48% to $323 million in the second quarter ended June 30, 2005;

Sales of CEFZIL, an antibiotic for the treatment of mild to moderately severe bacterial infections, decreased 57%, to $23 million in 2006 from $54 million in 2005, primarily due to generic competition in the U.S. Market exclusivity for CEFZIL expired in December 2005 in the U.S. and is expected to expire between 2007 and 2009 in countries in the EU; and,

Sales of TAXOL (paclitaxel), an anti-cancer agent sold almost exclusively in non-U.S. markets, decreased 20%, to $149 million in the second quarter of 2006 from $186 million in the same period in 2005, primarily due to increased generic competition in Europe. Market exclusivity for TAXOL expired in 2000 in the U.S., and in 2003 in countries in the EU. Two generic paclitaxel products have received regulatory approval in Japan, and one generic product has entered the market.

Revised consensus estimates call for 2006 and 2007 earnings-per-share estimate to be $1.05 and $0.75, respectively, from $1.17 and $1.22.

Paying out $1.12 in cash dividends, Bristol-Myers’ Common Stock yields 5.50 percent—which has been propping up the stock shares above the $20 support level. We warn our readers, however, not to be tempted to rush out to buy Bristol-Myers Common Stock, for its attractive yield is not secure.

The expected slowdown in growth prospects means that the Dividend Payout Ratio will jump from a prior estimate of 91.8% to 149.3% in FY 2007. A dividend cut is imminent. The trailing five-year average payout ratio in dividends is 85.8%. We are comfortable with this payout ratio—which translates into $0.65 per share.

Articulating the dividend cut thesis in financial jargon--in the last several years the Company's 'sustainable growth' [2.6% in 2005] has been lagging 'actual growth' [ROA - 10.2% in 2005] measures. Ergo, corporate cannot sustain growth prospects without "funding" that growth. Either management needs to kick up the profit [margin improvement gains alone will not do the job] or corporate will need to "fund" growth prospects [recently launched products & late-stage drugs in pipeline] from other sources. To ratchet up growth, the Company will likely pull from dividends.

The 10Q Detective suspects that management may target its underfunded defined benefit plan as a future “unnecessary” expense. The Company shelled out $459.0 million for retiree benefits in 2005 [flat compared to 2004], but the plan(s) remain underfunded by approximately $(1.3) billion.

A big offset to these costs that remains suspect is the Company’s expected long-term rate of return on its U.S. pension plan assets of 8.75 percent. Given that the target asset allocation is 70% equities—this return might be somewhat optimistic (especially when the legendary Bill Miller, long-term manager of Legg Mason’s Value Trust Fund, admits to having a tough year).

Until earnings accelerate, the dividend yield—was/is the principle valuation driver. If management cuts the dividend by half—the stock price could drop to $14.00 per share.

Valuation Analysis.

A share price in the teens would make Bristol-Myers an attractive BUY:

The Company has been divesting itself of low-margin, distracting businesses, such as (1) the 2005 sale of Oncology Therapeutic Network (OTN) for cash proceeds of $197 million. OTN generated net sales of approximately $1.0 billion for the first six months of FY 2005, but its contribution to the bottom line for the corresponding period was a loss, net of taxes, of $(5.0) million; and (2) the 3Q:05 non-core divestment of its U.S. and Canadian consumer medicines business to Novartis AG. Bristol-Myers Squibb's primary consumer medicine brands in the U.S. and Canada, including EXCEDRIN, KERI lotion, and COMTREX sales accounted for 1% of the Company’s sales in 2005.

The positive is that the PLAVIX exclusivity loss is a known variable and analysts are already reworking their valuations to price this into the Common Stock. In the coming quarters, corporate growth should start to reflect a healthy mix of new and existing products, including:

Total revenue for ABILIFY (aripiprazole), an antipsychotic agent for the treatment of schizophrenia, acute bipolar mania and bipolar disorder, increased 35% to $324 million in the second quarter of 2006 from $240 million in the same period in 2005;

Sales of ERBITUX (cetuximab), which is sold by the Company almost exclusively in the U.S., increased 76% to $172 million in the second quarter of 2006 from $98 million in the same period in 2005, driven by usage in the treatment of head and neck cancer, an indication that was approved by the FDA in March 2006, augmented by the continued growth for the treatment of colorectal cancer;

ORENCIA (abatacept), a fusion protein indicated for adult patients with moderate to severe rheumatoid arthritis who have had an inadequate response to one or more currently available treatments, such as methotrexate or anti-tumor necrosis factor (TNF) therapy, was launched in the U.S. in February 2006. Sales for the second quarter of 2006 were $18 million;

SPRYCEL (dasatinib), an oral inhibitor of multiple tyrosine kinases, received accelerated approval by the FDA on June 28, 2006, for the treatment of adults with chronic, accelerated, or myeloid or lymphoid blast phase chronic myeloid leukemia (CML) with resistance or intolerance to prior therapy, including GLEEVEC (imatinib mesylate); and,

ATRIPLA for the treatment of human immunodeficiency virus (HIV) infection in adults was approved on July 12. ATRIPLA is the first-ever once-daily single tablet three drug regimen for HIV intended as a stand-alone therapy in treatment-naïve patients or in combination with other antiretroviral ‘cocktails.’ This triple co-formulation could drive interest/use of the product—lower prescription co-payments and improved dosing compliance (convenience). At an estimated $14,000 per annum per patient for therapy, we believe that this drug could drive top-line growth—assuming drug resistance occurs later rather than sooner]. The product combines SUSTIVA (efavirenz), manufactured by Bristol-Myers Squibb, and TRUVADA (emtricitabine and tenofovir disoproxil fumarate), manufactured by Gilead Sciences (GILD-$62.05).

Bristol-Myers Squibb has more than 50 compounds in its pharmaceutical development pipeline. Ten promising compounds are currently in late-stage Full Development. Investors who buy on pullbacks could be well rewarded (as should existing—read patient—shareholders).

Corporate Governance

An analyst friend, Debra Fiakas, recently posted an excellent expose on “Executive Chicanery” in the Executive Boardroom at Bristol Myers on her blog, Small Cap Copy. We urge our readers to link to Debra’s article, for she does an excellent job in raising questions about the leadership abilities of Bristol-Myers Chief Executive Peter Dolan, who has been at the helm of the company during a major accounting scandal and the current PLAVIX mess.

There is also the problematic investment (overpayment concerns) in biotech company ImClone Systems Inc. (IMCL-$28.11). In the past five years, Bristol-Myers has invested almost $2 billion in ImClone (September 2001 BMY bought 14.4 million shares @ $70/share—cash plus $900 million in milestone payments in the last 5 years) to share revenue from one of the biotech company's promising cancer medicines, Erbitux (cetuximab).

This monoclonal antibody is believed to work by targeting a natural protein called "epidermal growth factor receptor" (EGFR) on the surface of cancer cells, interfering with their growth.

The drug is particularly effective in patients with tumors that express EGFR.

Erbitux was approved in 2004 for use in combination with the anti-neoplastic chemo-agent irinotecan in the treatment of patients with EGFR-expressing, metastatic colorectal cancer who are refractory to irinotecan-based chemotherapy, or alone if patients cannot tolerate irinotecan.

In March 2006, the FDA also approved ERBITUX for use in combination with radiation therapy for the treatment of locally or regionally advanced squamous cell carcinoma of the head and neck.

Although a “promising” treatment for other types of solid tumors that express EGFR, too, sales—to date—have been disappointing for its approved labeling. Additionally, Amgen (AMGN-$66.40) is expected to enter the market for colorectal cancer with its own EGFR targeting drug, Vectibix.

Today, Bristol-Myers 14,392,003 shares of Imclone are worth an estimated $404.6 million—an 80.3% loss in value (excluding $900 million in milestone payments).

Like their famous television ads of the 1960s & 1970s--just another "Excedrin headache" for Bristol-Myers Squibb shareholders.

Charles Bradlaugh (1833 – 1891), a colorful freethinker and political activist in England, said: “Without free speech no search for truth is possible... no discovery of truth is useful.”

Charles Bradlaugh (1833 – 1891), a colorful freethinker and political activist in England, said: “Without free speech no search for truth is possible... no discovery of truth is useful.”